Volver

Contents

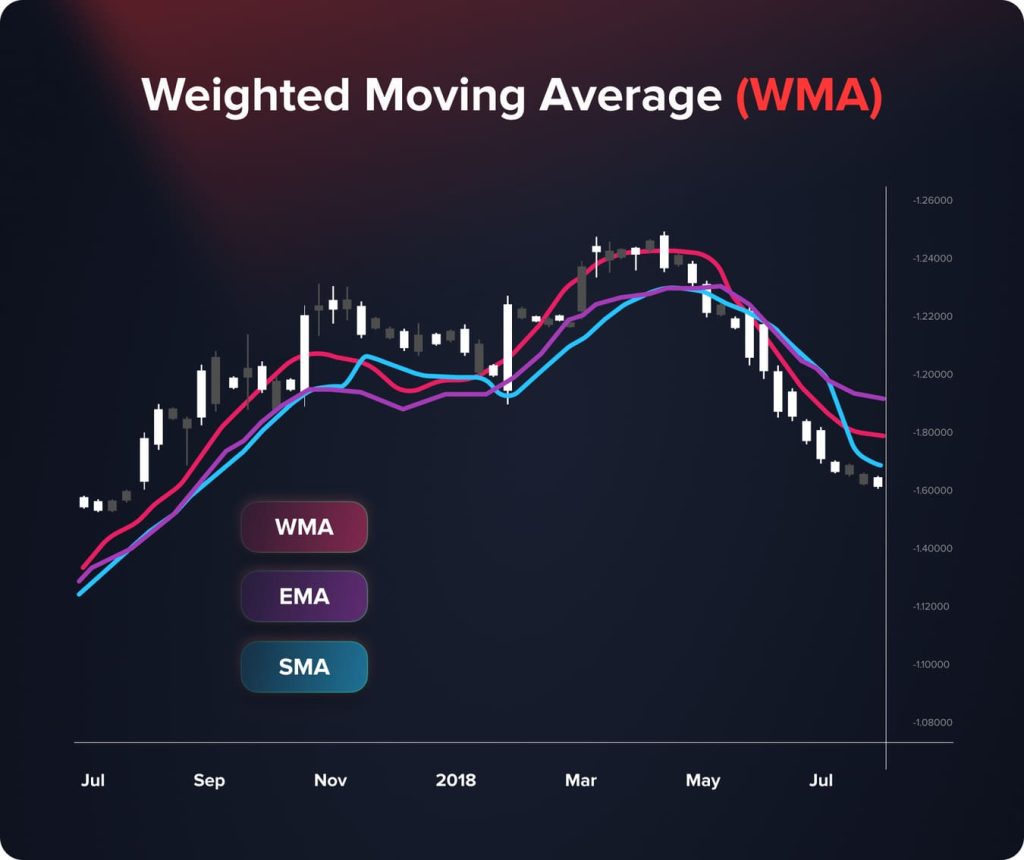

Weighted Moving Average Explained: Definition and Examples

Iva Kalatozishvili

Business Development Manager

Demetris Makrides

Senior Business Development Manager

The Weighted Moving Average is a type of the Moving Average indicator which assigns the value for every price level. According to the instrument, the latest prices get higher value than the initial ones, and affect the indicator more.

Key takeaways:

- What are the types of the Moving Average indicator?

- What does the Weighted Moving Average (WMA) mean?

- What is the Weighted Moving Average formula?

- How to use the WMA instrument?

- Pros and cons of the WMA indicator?

- Which type of the Moving Average is better?

Moving Average. Definition and Types of the Instrument

Moving Average indicators are among the most widespread instruments that are used to identify a current market trend. Such indicators are equally useful on different timeframes. Furthermore, many well-known technical instruments like MACD and Bollinger Bands are based on Moving Averages.

The main goal of the Moving Average indicator is to smooth out price fluctuations, reduce market noises, and empower traders to determine a current market trend. When reducing price noises, traders get a clearer picture of what is going on in the market.

There are many types of the Moving Average indicator, and the most widespread types are the following ones: Simple Moving Average (SMA), Exponential Moving Average, and Weighted Moving Average (WMA). Let’s dwell on them in detail to understand the differences.

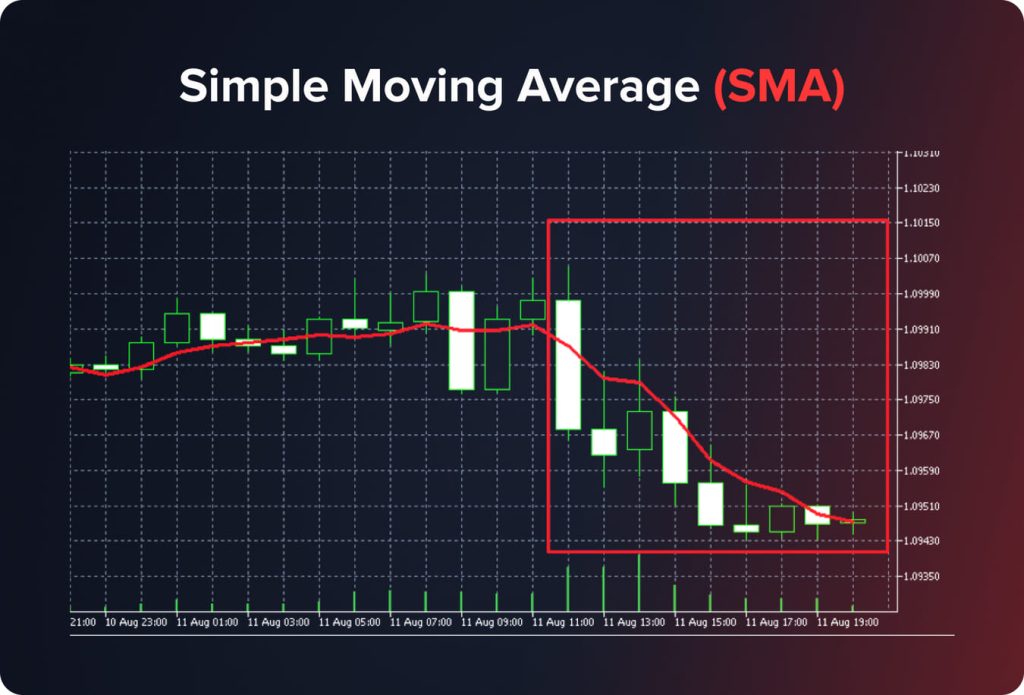

Simple Moving Average (SMA)

The Simple Moving Average assigns the same value for all price levels. The indicator is based upon close prices.

For instance, a trader activates SMA with a 5-day period. Let’s find out the latest five price levels (close prices) for every period:

Then we need to get the average for every period – we sum up all the close price values and divide by their numbers (5). As a result, we get the following values: 1.09475, 1.09491, 1.09542, 1.09565, 1.09612.

The above-mentioned values are points through which the SMA line is built.

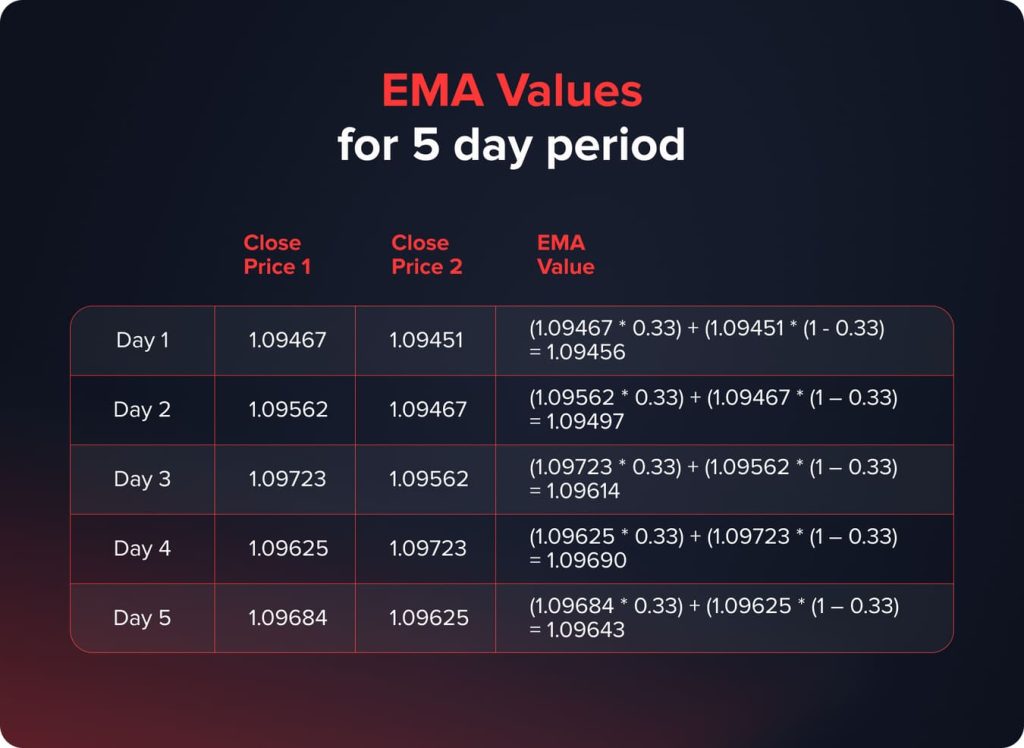

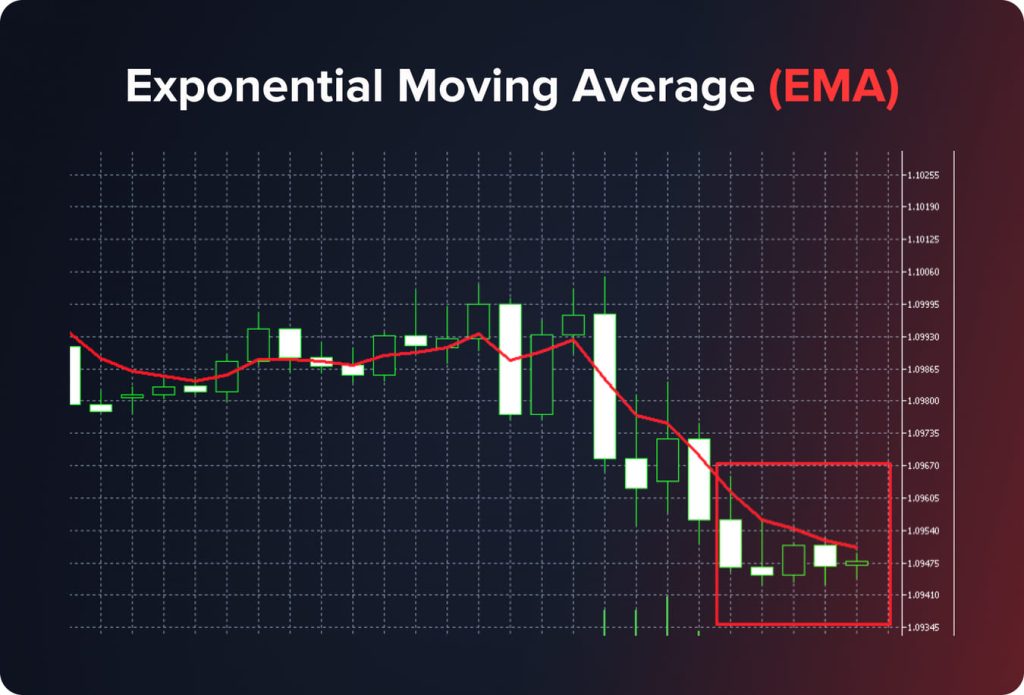

Exponential Moving Average (EMA)

The Exponential Moving Average assigns more value to the latest prices. As such, the indicator helps traders identify trend changes more quickly. EMA relies on a certain multiplier (coefficient). The multiplier is used to smooth the indicator and give more weight to the later periods.

The multiplier is calculated using the following formula:

M = (2 / (P + 1)

In this formula M means multiplier, and P is the designation of the number of periods.

For a 5-day EMA the multiplier is (2 / (5+1) = 0.33.

Furthermore, we need to take into account the EMA formula which looks like:

EMA = (CP * M) + (CP-1 * (1 – M)

CP – close price;

CP-1 – close price of the previous period;

M – multiplier.

Let’s calculate the EMA values for the data given in the above-mentioned table.

The above-mentioned values are points through which the EMA line is built.

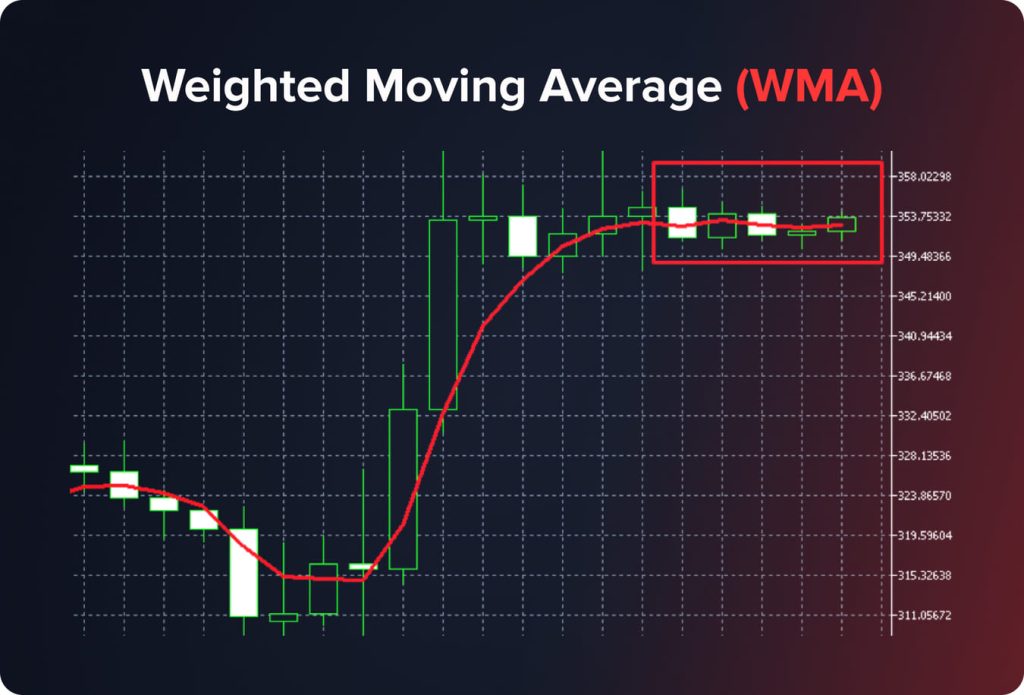

Weighted Moving Average (WMA)

WMA gives more value to the latest periods, but not exponentially as the EMA indicator does. Such an approach makes WMA not so fast but the instrument still reacts quickly to price changes.

What is the WMA Indicator?

According to the WMA indicator, the first period gets the least weight, the medium periods obtain medium value, and the latest periods are the most important and get double weight in the calculation. To understand better how this MA variation functions, we need to decode the WMA formula.

What is the Weighted Moving Average Formula?

When calculating WMA, each period has its own weight that directly depends on the overall number of periods.

Calculating WMA involves a multi-step process that assigns weights to different data points based on their chronological order. For instance, we need to activate a 5-days WMA.

- Identify the weight of every period. The first period gets the least weight (1), and the latest period gets the highest value (5). The sum of all values inside the WMA 5 is 15 (1 + 2 + 3 + 4 + 5).

- Calculate weighted values. Multiply close prices by their ratios.

- Add up all weighted values to get the sum of weighted values. The sum is equal to 352.714. Thus, we got the Weighted Moving Average for the p periods, from August 9 to August 13.

How to Use the WMA Indicator for Predicting Future Price Movements?

Weighted Moving Average is a technical indicator that is versatile and easy to use; which is why traders frequently add it to their strategies. Here are some widespread cases of using the instrument:

Filtering trends when analyzing multiple timeframes

Professional traders analyze multiple timeframes to understand which trading signals are true, and which ones are false.

- Identify a trend direction on the H4 or D1 timeframe. Then utilize the WMA 200 indicator to understand in which position the current asset’s price is. When the price is above the WMA 200 line, start looking for buy signals only. When the price is below the WMA 200 line, you need sell signals only.

- Switch the timeframe to the H1 option and activate indicators to find either buy or sell signals.

- Open a position and place stop-loss orders just below the lowest swing point (for a long position) or just above the highest swing point (for a short position).

Using Weighted Moving Average as a dynamic stop-loss order

Taking into account the fact that WMA pays more attention to short-term prices, some traders utilize the indicator as a stop-loss instrument in impulse deals. For instance, when a WMA 20 line is higher than a WMA 100 line, traders may open long positions waiting for a sharp upward movement. Instead of setting take-profit orders, traders dynamically track the market through the WMA 100 line using it as a trailing stop-loss instrument.

When an asset’s price touches the WMA 100 level and then breaks it, traders close a position. The benefit of such a strategy is that when a current trend stays in the market and the stop-loss level is not broken, the WMA 100 will exceed the entry price; which means a trader definitely gets profit.

Pros and Cons of the WMA Instrument

Here are the core pros of the Weight Moving Average:

- WMA is more sensitive to recent trends. The indicator gives more weight to the latest periods; which is why it is exceptionally effective for short-term price movements. Traders who prefer short-term trading strategies widely use different WMAs.

- Timely signal redirections. The instrument quickly reacts to price updates and provides traders with the most accurate information about support and resistance levels. This data helps traders enter or close positions timely, increasing profits or minimizing losses.

- Adjustable timeframes. The Weighted Moving Average is equally effective on diverse timeframes; which is why traders may easily adapt the instrument to their styles and strategies.

When talking about cons, the following weak points of the Weighted Moving Average are pointed out:

- High noise level. Despite the fact the sensitivity of the WMA is mentioned among the advantages, it leads to high noises and false signals. Traders should utilize some additional indicators to get some proof.

- Lagging to fast price movements. Despite the focus on the latest prices, WMAs can still lag to exceptionally rapid price movements. As a result, traders lose certain opportunities.

- Limited functionality in certain markets. The efficiency of the Weighted Moving Average directly depends on the volatility. On the volatile markets the instrument becomes less effective.

Which is Better, EMA or WMA?

Moving Averages are rich in variations; therefore, traders need to understand which MA type is the best solution.

WMA Vs SMA

The core difference between SMAs and WMAs lies in the peculiarities of weighting systems. The Simple Moving Average equalizes all the price levels, while the WMA understands latest prices as more important ones.

As such, SMAs are more effective for identifying long-term trends and opening long-term positions. The Weighted Moving Average is more sensitive for short-term price movements and is the best solution for traders who bet on short-term strategies.

WMA Vs EMA

Both WMAs and EMAs set different weights for different prices and are more sensitive for the recent price changes. Despite the fact that WMA and EMA have much in common, their weighting approaches are still different. Which variation is better for a trader?

The WMA indicator pays more attention to the latest prices due to the system of multipliers. That means within strong trends the WMA line is closer to an asset’s price when compared to SMAs and EMAs.

The WMA is more effective in predicting trend changes, as the indicator reacts to price changes as quickly as possible.

When talking about the efficiency of every variation of the Moving Average, the choice should depend on which timeframe, trading style, and trading strategy you prefer.

Bottom Line

The Weighted Moving Average is an effective technical indicator that helps traders identify trend changes and quickly react to them. According to the WMA formula, the recent price levels get the highest value; which is why such an indicator is especially useful for those traders who work with short-term trading strategies.

FAQ

The effectiveness of the WMA indicator directly depends on the trading conditions. The instrument is more effective for short-term trading, as it rapidly reacts to price changes.

According to the WMA, the earliest periods get lower values, and the latest periods get the highest values. The weight is calculated with the help of multipliers.

The Weighted Moving Average is among the standard instruments added by default to the vast majority of trading terminals. That is enough to activate the Moving Average indicator, then switch its type to ‘Weighted.’ Customize the period based on your trading strategy.

Actualizado:

19 de diciembre de 2024