Quay lại

Contents

Time in Force Orders Explained: Definition and Types

Vitaly Makarenko

Chief Commercial Officer

Demetris Makrides

Senior Business Development Manager

Time in force orders fall into the category of automated tools that empower traders to indicate some preconditions of their deals according to which those orders remain active before being executed or expired.

Key takeaways:

- What is a Time in force order?

- Types of time in force orders?

- Examples of time in force orders.

- Where and how to set time in force orders?

- Pros and Cons of time in force orders.

This category of orders helps traders effectively manage their positions to minimize possible risks. Let’s dive deeper into what a time in order (TIF) means, and which types are the most useful in different markets.

What Does TIF Mean in Trading?

Beginner traders who are going to make their first steps in financial markets recognize basic order types that are market and limit orders. Meanwhile, professional traders go beyond the borders of the basic orders, understanding the value of time. Those basic orders contain some specific variations that enable traders to specify time periods during which an order remains active before it is executed or cancelled.

From a trader’s viewpoint, time is the most valuable source that should be used properly. The opportunity to control the expiration time of an order provides traders with flexibility in the execution of their trading strategies. TIF orders enable traders to adapt to the changing market conditions ensuring that their orders are active until the moment when it becomes unprofitable to open a position.

What is the TIF Formula?

The category of TIF orders contain different types that are characterized by a certain set of preconditions. The execution peculiarities depend on those preconditions.

Types of TIF Orders

We need to dwell on each type of a TIF order in detail to understand how such tools function and why those are popular among professional traders.

Day Order

Day orders are active within a trading day only. If it remains not executed, the order will be cancelled automatically.

For instance, a trader is going to buy TSLA shares expecting a price drop due to negative news. He sets the limit price and adds his order to the order book. When the asset’s price reaches the indicated level, the order will be executed; otherwise, it will be active until the end of a trading day and then cancelled automatically.

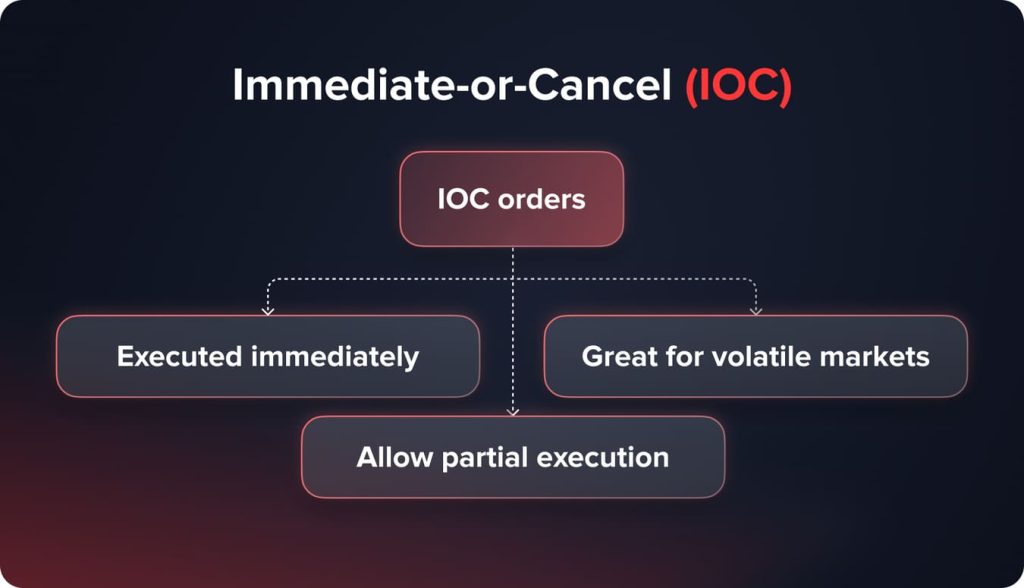

Immediate-or-Cancel (IOC)

IOC orders are tools that prescribe immediate buying or selling an asset. According to this order type, any part of the order that cannot be executed immediately is cancelled.

When it comes to an IOC order, traders may set the following preconditions: price and volume. They may select either market or limit orders and indicate an asset’s volume they are going to buy or sell.

For instance, a trader needs to buy 10 BTC at the price of $60,000. He places an Immediate-or-cancel order. Meanwhile, the order book is able to execute orders for 4 BTC at the given price. Based on the rules of the IOC order type, a trader gets 4 BTC on his portfolio, and the rest of his order is cancelled.

Good-till-Cancelled (GTC)

The GTC order remains active till it will be either executed or canceled. Such an order is not canceled automatically at the end of a trading day.

Most brokers enable traders to set time limits during which GTC orders remain active. Those limits usually vary from 30 to 90 days. Good-till-cancelled orders are supposed to be executed at a price that differs from the current market one.

Furthermore, traders frequently open a number of GTC orders combining them into groups of mutual cancellation. When one order is executed, others are canceled automatically.

For instance, a trader needs to purchase AAPL shares at the price of $220 per share; meanwhile, the current asset’s price is $229.5. Traders place a Good-till-cancelled order that remains active for weeks and even months. As such, traders do not need to monitor the asset’s prices constantly and may focus on other deals.

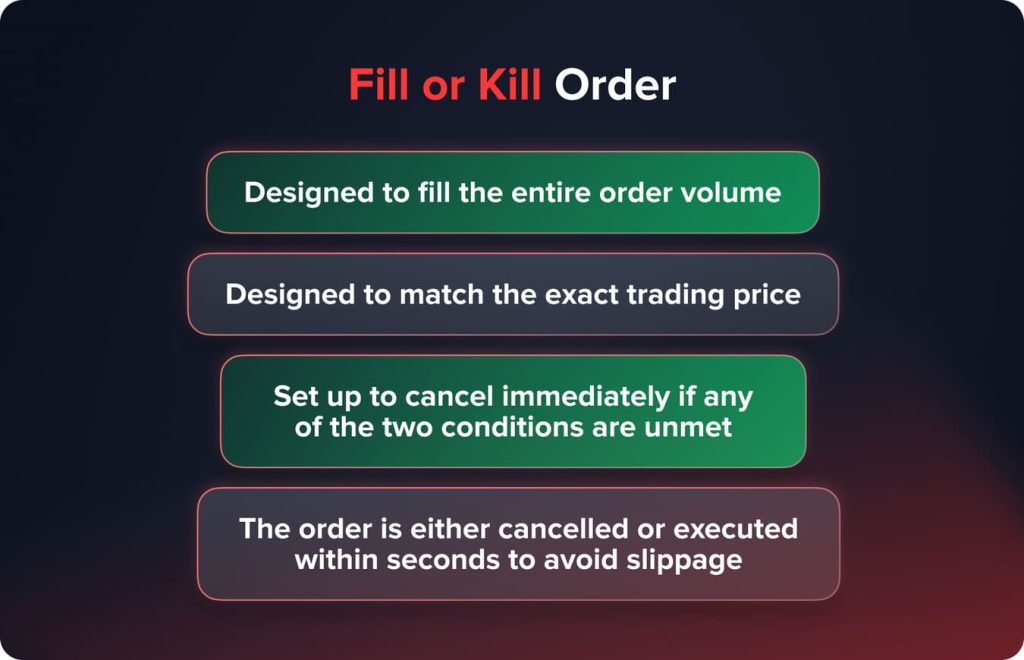

Fill or Kill (FOK)

Fill-or-kill orders are supposed to be executed immediately after being created. It is important that such an order needs to be executed in its entirety. No partial executions are possible. When the entire execution is impossible, FOK orders are cancelled.

Price and volume conditions serve as strict limitations. The whole order either corresponds to the set conditions or is canceled immediately.

When compared to the IOC type, Fill-or-kill orders are stricter; therefore, such orders are going to be executed with a much lower probability.

For instance, a trader needs to purchase 1000 shares of a certain corporation at the price of $25 per share. It is important to purchase 1000 shares at the given price immediately. In such a case, you need to open a Fill-or-kill order. If a brokerage is ready to sell 1000 shares at the $25 price, this order will be executed. When a brokerage company is ready to sell a lower amount of shares at the $25 price (e.g., 800 shares), the Fill-or-kill order will be canceled.

You may also like

Market on Open (MOO)

The Market-on-open order means that a position is going to be executed at the day’s opening price. Such an order can be executed only at the market opening or shortly thereafter the market starts working. Note that Market-on-open orders can be executed at the first printed price only.

Here is the procedure of how a Market-on-open order works:

- Traders place their MOO orders after the market is closed. Such orders can be created right up until the moment when there is 2 minutes left before the market opening.

- Market makers use those 2 minutes to understand how many MOO orders are placed and what are the volumes such orders contain.

- Market makers adjust their bid prices based on the MOO orders. As such, the first printed market price is established.

- Market-on-open orders are executed or canceled within the first hours of the trading session. The exact time depends on a certain exchange. For instance, NASDAQ executes MOO orders till 9:28 a.m. (ET).

Market-on-Close (MOC)

Market-on-close orders are opposite to MOO ones. Such orders are placed near to the market’s closing price or shortly thereafter the market trading session ends. The core goal of a MOC order is to catch the last available price.

Note that Market-on-close orders are available just in some markets and suggested by certain brokers only.

Time limits till a trader can place a MOC order depends on a certain exchange as well. For instance, at the NYSE you may open Market-on-close orders till 3:50 p.m. (ET) but you cannot cancel or change the conditions of your order after 3:45 p.m. (ET).

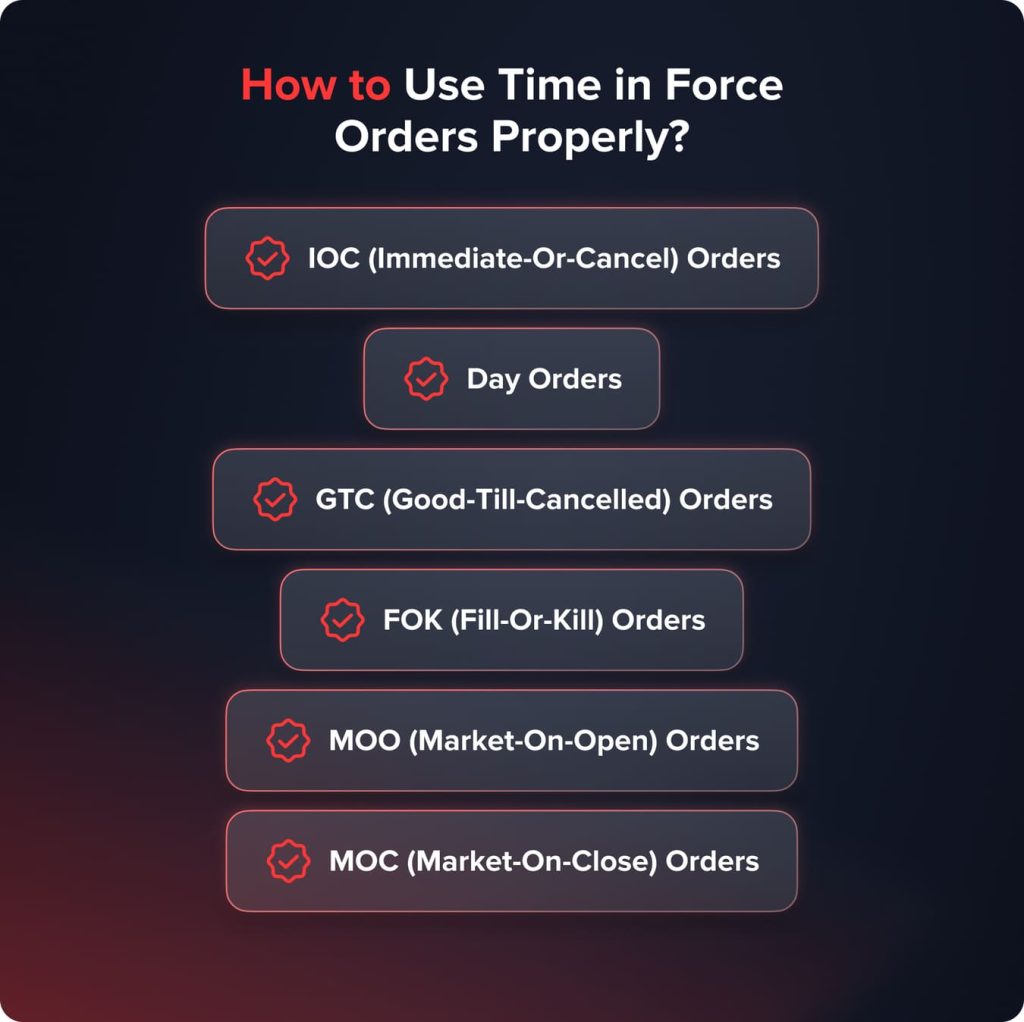

How to Use Time in Force Orders Properly?

TIF orders expand the opportunities of a trader; meanwhile, that is important to utilize such orders properly. What are the recommendations on how to use each type of the Time in Force order?

Day orders

Such an order type is useful for intraday traders who get an opportunity to open positions for several assets simultaneously without the necessity of constantly monitoring an asset’s price for the rest of the day.

An intraday trader makes a profound analysis before the market opens. They analyze every asset independently and then open positions according to the chosen trading strategy.

As such, when an asset’s price doesn’t reach the necessary price level, an order will be canceled at the end of a trading day.

IOC (Immediate-or-cancel) orders

Investors prefer to open Immediate-or-cancel positions when they need to place a large order and avoid its executions at different prices. The IOC type means that the rest part of an order that cannot be executed immediately, is canceled.

First and foremost, such an order type is useful for volatile markets. Furthermore, IOC orders are widely used by intraday traders who open several positions. Immediate-or-cancel orders minimize their risks as traders won’t forget to cancel a position before the market closes.

GTC (Good-till-cancelled) orders

Good-till-canceled orders are most useful for long-term investors. Based on the asset’s analysis investors identify price levels at which they are ready to buy or sell assets. In order to avoid constant monitoring of an asset’s price investors place GTC orders.

On the other hand, investors should not ignore the risks of GTC orders. Many exchanges, including the world’s leading ones, understand Good-till-cancelled orders too risky for investors; which is why the platforms forbid investors to place such orders. Hence, brokerage firms still accept GTC orders and execute them internally. On the volatile markets a sharp price movement may execute a GTC order and then snap back. Investors are recommended to utilize Good-till-cancelled orders on price-sensitive markets, not on volatile ones.

FOK (Fill-or-kill) orders

Fill-or-kill orders are the best choice for volatile markets. A trader understands that high volumes may bring high profits; which is why they place large orders. Meanwhile, when the order book doesn’t contain enough liquidity to execute large orders immediately, they should better exit the market.

FOK orders help investors minimize their risks and do not spend their time dealing with micro profits.

MOO (Market-on-open) orders

Market-on-open orders are widely used within news trading. Traders analyze the current or upcoming news and understand that buying or selling of the chosen asset is the best solution.

For instance, during the earning season the vast majority of corporations disclose their financial results when the markets are closed. Hence, sharp price movements are expected right after the next day market opening.

On the other hand, wrong predictions may lead to heavy losses; which is why investors need to be sure the upcoming event is going to affect an asset’s price significantly.

MOC (Market-on-close) orders

The use cases of MOC orders are also connected with news trading. An investor predicts sharp price movements after the market closes due to scheduled reports or upcoming important news and open positions in the same directions. When a trader expects the price growth he opens an order to buy an asset, and vice versa.

Pros and Cons of Time in Force Orders

The category of TIF orders is characterized by the following advantages:

- TIF orders expand the opportunities of traders empowering them to adjust their positions to different market conditions.

- Time in Force orders save much time of a trader as he doesn’t need to constantly monitor different positions.

- TIF orders are suitable for different trading styles and strategies. Furthermore, such orders can be utilized in diverse financial markets.

When talking about the cons of TIF orders, the following weak points are pointed out:

- Time in Force orders may create additional risks when utilized on volatile markets, as sharp price movements may execute such an order and then roll back.

- TIF orders require profound analysis and thorough thinking of which price and volumes to set; which is why those orders are too difficult for newcomers.

Bottom Line: TIF Orders as Auxiliary Tools of a Professional Trader

The category of Time in Force orders significantly enlarges the opportunities of professional traders. Such orders save much time and minimize risks; meanwhile, a trader needs to analyze the market properly and set the right price and volumes.

FAQ

One cannot distinguish the most and the least useful TIF order as different types are suitable for different trading styles and market conditions.

IOC and FOK orders are the best ones to utilize on the volatile markets, as those orders help traders to avoid the execution of their orders at different prices.

Intraday traders frequently use day orders so that they could monitor multiple assets simultaneously. Furthermore, Immediate-or-canceled orders can be used by intraday traders as well.

Đã cập nhật:

7 tháng 4, 2025