Quay lại

Contents

Mastering Binary Options: Types, Strategies, and Risks

Trading

Demetris Makrides

Senior Business Development Manager

Iva Kalatozishvili

Business Development Manager

Binary options are a type of financial derivative that offers traders a yes-or-no proposition on the future price of an underlying asset. These options have a clear, preset outcome: a specific monetary gain or a loss. Binary options have grown in popularity, particularly among novice financial traders, owing to its simplicity and appeal of quick returns. However, the traits that make binary options simple and accessible also pose major dangers such as a high chance of losing money and exposure to unregulated platforms that are often fraudulent. To provide prospective traders with an extensive understanding of binary options, this article goes into its mechanics, kinds, methods, and inherent risks and rewards.

Definition and Mechanics of Binary Options

Binary options are unique financial products that function on a simple concept but demand a thorough knowledge owing to their dual nature, which provides just two outcomes. The price movement of a particular item, such as a stock, commodity, currency pair, or index, is the basis for binary options, which are based on a straightforward yes-or-no strategy.

As an illustration of a standard binary option, consider the following example: “Will gold cost more than $1,830 at 1:30 p.m. today?” In the event that the condition is satisfied beyond the expiry date, the option will either pay out the specified return or become worthless.

Core Components and Trade Mechanics

Every binary option has basic features like the strike price, a preset price level the asset must either exceed or fall below, and the underlying asset, which forms the basis for the proposition of the option. Moreover, binary options have a set expiration period that could run from minutes to many days or weeks.

When starting a trade, the trader specifies an underlying asset, a strike price, and an expiry period. The trader then allocates a particular amount of money to the transaction by acquiring the option. This procedure is usually supported by internet trading platforms, which offer an interface for placing transactions. These systems provide the predicted payment %, allowing traders to predict their future gains or losses in advance.

The result of a binary option is decided upon its expiry period. Should the market circumstances match the proposition – that is, if the price of the underlying asset is truly higher than the strike price for a call option – the trader gets a predefined dividend, a proportion of the original investment. On the other hand, should the condition fail, the option expires worthless and the trader loses all the money paid on that transaction.

One of binary options’ distinguishing features is its automatic settlement capability. Unlike many conventional trading products, binary options do not need human execution during settlement. Instead, they are meant to conclude instantly, with the trader’s account promptly reimbursed or the deal recorded as a loss.

Binary options attract individuals seeking fast and simple trading possibilities because of its structural simplicity and binary character of the outcomes—where traders either suffer a whole loss or receive a predefined a reward. Nonetheless, its fundamental simplicity also conceals the great dangers involved as the market circumstances are unpredictable and loss is very common. Therefore, anybody thinking about binary options as part of their investment plan should fully grasp these mechanics to properly negotiate the risks.

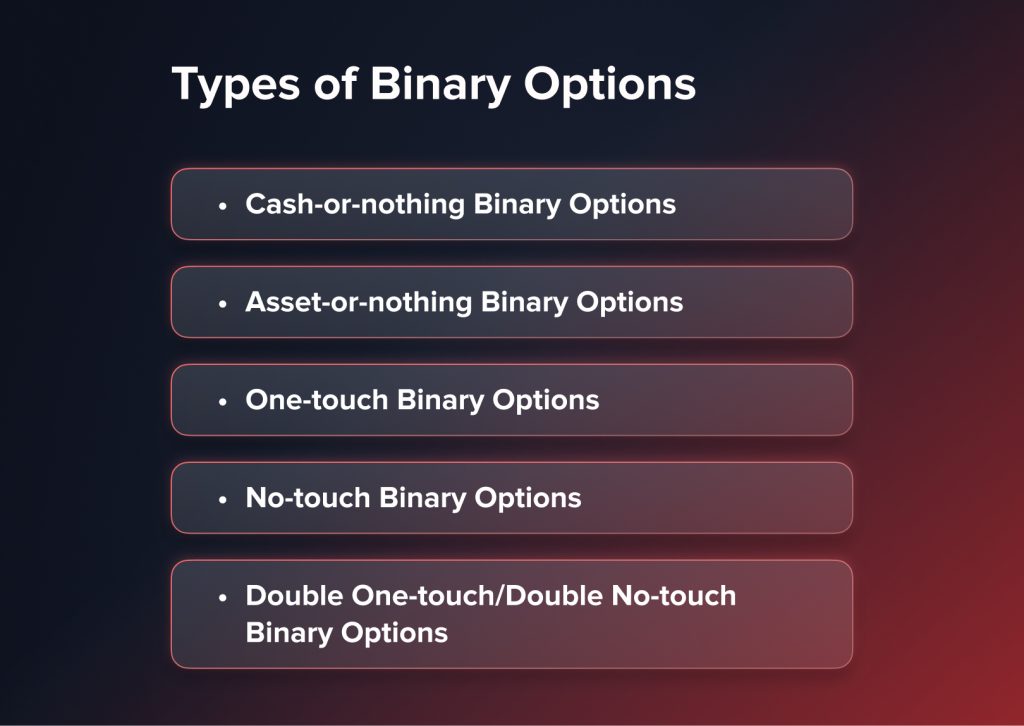

Types of Binary Options

Binary options are categorized by the conditions and events that determine when they pay out. This gives traders a number of ways to bet on how the market will move or protect current accounts. There are different types of binary options for traders with different risk tolerances and trading styles.

Cash-or-nothing Binary Options

This is the most basic and often traded kind of binary options. Cash-or-nothing options pay out a predetermined amount if they expire “in the money.” Basically, if the price of the asset is on the right side of the strike price at expiration, meaning that the trader made the correct call, the trader receives a specified amount of cash. If the option expires “out of the money,” the trader will lose the amount deposited.

Asset-or-nothing Binary Options

Asset-or-nothing options are similar to cash-or-nothing options in terms of the conditions that trigger a payment, but they vary in the kind of reward received. If the option expires in the money, the payoff is the value of the underlying asset rather than a preset cash sum. This kind is more like standard options, with a payment that matches the asset’s real market price upon expiry.

One-touch Binary Options

Payment will be made to the trader in the event that the underlying object’s price reaches a specified level at least once before to the option’s expiration. Importantly, unlike traditional options, the trigger for one-touch options is not based on the price at expiry but on the price reaching the amount you specify. When markets are unstable, this type of option is very common because it lets buyers profit from sudden changes in price.

No-touch Binary Options

No-touch options work on the opposite concept as one-touch choices. If the price of the underlying asset does not reach a specific level before the expiry date of the option, a payment is given. This kind is popular among traders who think the asset will move inside a certain range throughout the option term.

Double One-touch/Double No-touch Binary Options

The double one-touch and double no-touch options are more elaborate than the standard one-touch and no-touch alternatives. A double one-touch option pays out if the asset achieves one of two predefined price levels before expiring, which increases the likelihood of a payment in a turbulent market. A double no-touch option, on the other hand, pays out only if the price does not fall below either of the stated thresholds throughout the option’s tenure. These are appropriate for situations in which traders anticipate strong volatility but are unclear about the direction.

You may also like

Various Trading Strategies

Understanding the principles of the option type is crucial to negotiate the binary options market properly before using deliberate trading strategies. These techniques are supposed to meet different risk tolerances and market beliefs, thereby allowing traders to increase their chances of success and minimize expected losses.

Trend Following Strategy

This is one of the most straightforward and popular strategies for binary options trading. It entails identifying the underlying asset’s major trend and trading accordingly. Traders using the trend-following technique would purchase a “call” option on an asset whose value has been gradually increasing. They would do this because they believe the asset will continue to go up until the option expires. The strategy would include a “put” option if the direction is down, which means the price is expected to keep going down. This method is most useful in markets with strong, consistent fluctuations.

Pinocchio Strategy

The Pinocchio method, named after the classic figure whose nose grows when he lies, involves betting against the market when current trends deviate significantly. This technique assumes that extreme swings or “lies” in market prices are corrections that will ultimately return to the mean or reverse entirely. Traders utilizing this approach watch for candlesticks or price bars that deviate considerably from the price movement, signaling a possible reversal. When such a bar appears on a chart, traders will take a position opposed to the current trend.

Straddle Strategy

Because it works so well amid market volatility, the straddle approach is great for binary options trading. This approach entails the trading of both “call” and “put” options on the same asset with the same expiration time. The goal is to capitalize on large changes in either direction. This method becomes beneficial when the asset price moves dramatically in either direction; if the price swings are large enough, one of the options will pay out more than the cost of both holdings, resulting in a net profit.

Risk Reversal Strategy

The risk reversal approach is typically used as a hedging mechanism to protect other assets or transactions. In binary options, this might imply establishing a position opposite to one placed in the conventional market. For example, if a trader has a long position in an asset in the traditional market, they may purchase a “put” option in binary options. This strategy helps to balance possible losses in one market with profits in another, which is especially effective in volatile or unexpected markets.

Each strategy serves a particular goal and is appropriate for a variety of trading styles and market circumstances. By combining a thorough grasp of market dynamics with these strategic techniques, traders may increase their chances of success in the binary options market. However, traders must stay cautious and adaptive, always analyzing their methods in light of market circumstances and making adjustments as needed.

Risks of Binary Options

Binary options trading, while accessible and potentially profitable, carries a set of unique risks and benefits that traders must consider. This dual nature influences individual trading experiences and impacts the overall perception of binary options in financial markets.

Regulatory Concerns

One of the biggest concerns involved with binary options is that many of them are traded on unregulated platforms. This lack of regulation considerably raises the potential of fraud, since traders may use systems with no protection against malpractice. Unregulated platforms may not follow basic financial standards intended to safeguard investors, making it harder to seek solutions in situations of fraud.

All-or-Nothing Outcomes

Binary options are designed to offer either a specific monetary sum or nothing at all, depending on whether a predefined condition is satisfied. If the proposition is not met, this all-or-nothing structure might result in a complete investment loss. Such results mean that, although the risks are limited to the original investment, there is a substantial possibility of losing the whole investment if the market does not move as expected.

Market Volatility

Binary options are often subject to rapid and substantial price changes in their underlying assets. This volatility may have a major impact on trading outcomes, especially as options approach expiry. Volatility may unexpectedly change apparently strong positions into losers, complicating the approach and possibly resulting in quick financial loss.

You may also like

Benefits of Binary Options

Defined Risk

The disclosed risk of binary options is among its most enticing features. When traders start a trade, they are precisely aware of the potential loss or gain involved. At the beginning of the trade, this preset risk is determined, which helps traders properly manage risk and be ready for any losses. Binary options appeal especially to risk-averse people or those new to financial trading because of its clarity and certainty in risk assessment.

Simplicity

Binary options are known for their simplicity. Unlike traditional options, which have a range of potential outcomes and may need extensive strategy, binary options provide a straightforward proposal. Traders merely need to predict if a certain event will occur, such as whether an asset will be above or below a predetermined price at a particular period. This simplicity makes binary options simpler to understand and trade, especially for people with no trading expertise.

Accessibility

Binary options trading is easily accessible to a wide range of people due to its minimal entry criteria. Many binary options platforms enable traders to join with a small initial deposit, decreasing the barrier to entry when compared to other trading types that may need large resources. This accessibility welcomes new traders and offers a convenient starting point for those wishing to diversify their financial methods without committing significant capital.

Conclusion

Under the correct circumstances, binary options provide a one-of-a-kind trading potential for profit. However, they also pose major hazards that should not be overlooked. Traders must approach this financial instrument with a well-planned strategy and an acute understanding of the possible losses. Educating oneself on the regulatory environment and practicing on demo accounts may also assist reduce some of the dangers involved with binary options trading.

Đã cập nhật:

18 tháng 12, 2024

12 tháng 3, 2025

NEW POST FOR TESTING BLOG AND WP

What is Lorem Ipsum? test link with http Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only […]