กลับ

Contents

How to Trade Cryptocurrency? – Beginners Guide

Trading

Demetris Makrides

Senior Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

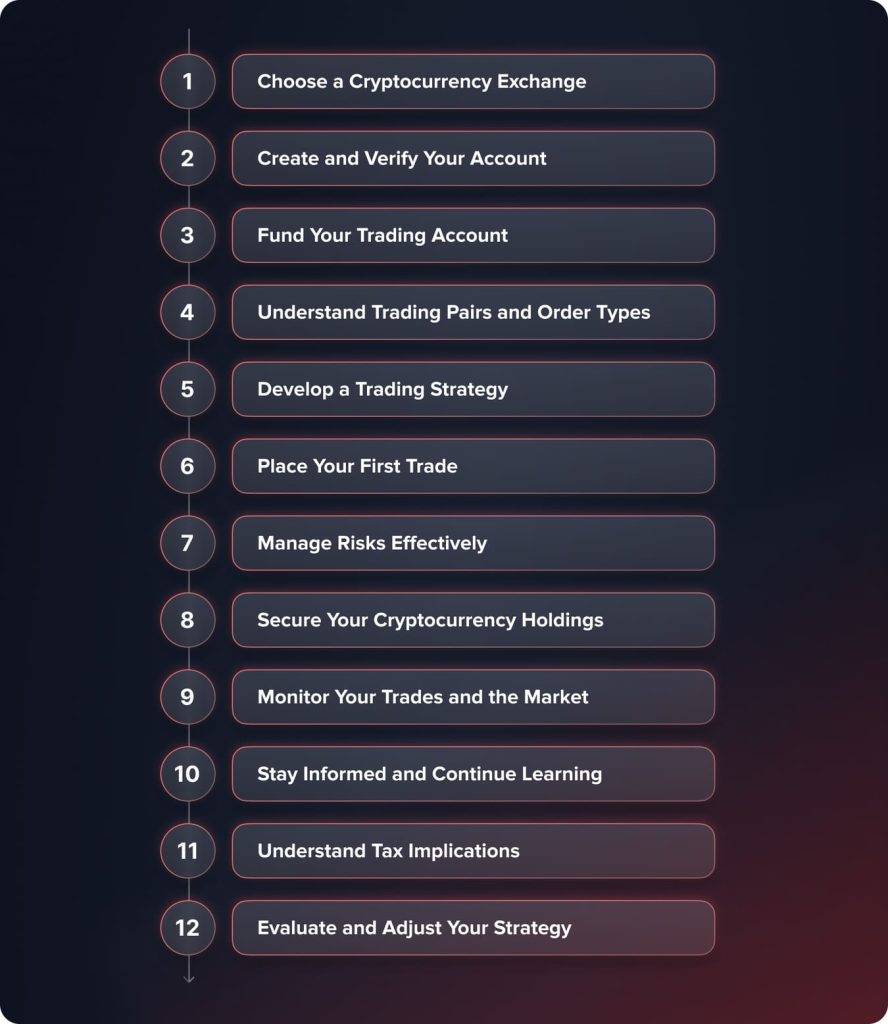

Trading cryptocurrencies is basically buying and selling of digital assets in order to make a profit from changes in the market. Being new, the idea of negotiating this often changing market may be scary; yet, knowing the primary stages can help you start trading with confidence. This guide provides a thorough review of the crypto trading process along with tips on selecting an exchange and risk management strategies.

Let us now examine closely every one of the stages.

Choose a Cryptocurrency Exchange

The first important step in trading cryptocurrencies is selecting a reliable exchange suitable for your needs. All of the trading of cryptocurrencies happens at exchanges. When choosing an exchange take security needs, regulatory compliance, supported cryptocurrencies, fee policies, user interface, and customer care under review.

Above all, security is vital; look for exchanges utilizing strong security mechanisms like cold storage for currency, encryption, and two-factor authentication. Ensuring regulatory compliance guarantees that the trade follows legal guidelines in your country, thereby offering yet another degree of security. Furthermore, the spectrum of available cryptocurrencies is significant; be sure the exchange supports the digital assets you want to trade.

Exchanges have different charge structures; hence, to get reasonable rates, compare deposit costs, withdrawal fees, and trading fees. Particularly for beginners, a user-friendly interface may help the trading process to be simpler. Finally, resolution of any problems that could develop depends on timely customer service.

Popular exchanges for beginners include Coinbase, Binance, Kraken, and Gemini, each with unique tools and features to fit diverse user preferences.

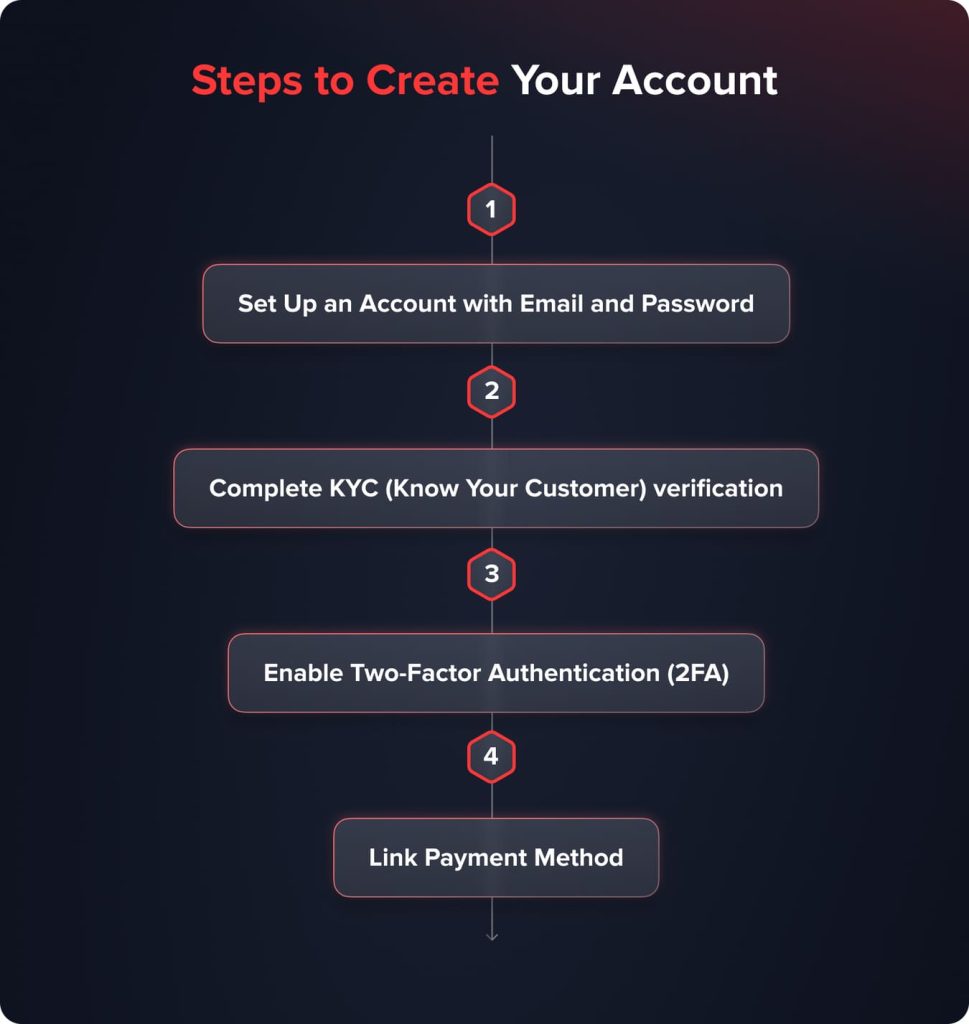

Create and Verify Your Account

Creating an account comes second after you have chosen an exchange. Start by adding your email address and setting a strong, distinctive password. Know Your Customer (KYC) identification verification is often required of most licensed exchanges. To prove your identity, this procedure entails turning in identification documents like a driver’s license or passport.

Turn on two-factor authentication to further protect your account after the verification procedure is finished. When logging in or completing certain tasks, this provides even more security by requiring a second kind of verification—a code taken from an authentication app.

Link your account to credit card, bank account, or any payment method the exchange offers. Your trading account may be funded using that method. You should finish the verification procedure right away to avoid any delays when ready to start trading.

Fund Your Trading Account

Depositing money comes next after your account is set up and confirmed. You may fund your trading account with fiat money or by moving crypto from another wallet.

Depending on what options the exchange offers, you may use a credit or debit card or transfer money from your bank account for fiat deposits. Know any related costs and processing periods; they will vary depending on the payment type and currency.

Should you already hold cryptocurrencies, you may deposit them into your exchange wallet. Get the special wallet address from the exchange for the particular coin you want to deposit to do this. Since crypto transactions are permanent and irreversible, make sure you verify the wallet address and other transaction information before approving the transfer.

Understand Trading Pairs and Order Types

Trading pairs—that is, pairings of assets—are used in cryptocurrencies trading. For instance, BTC/USD shows Bitcoin exchanged against US currency. Knowing trading pairings is crucial as it determines how you might trade one crypto for another or for cash.

The first currency in the pair—e.g., BTC in BTC/USD—is the base currency; the second is the quote currency—USD in BTC/USD. Purchasing a trading pair means selling the quote currency while purchasing the base currency.

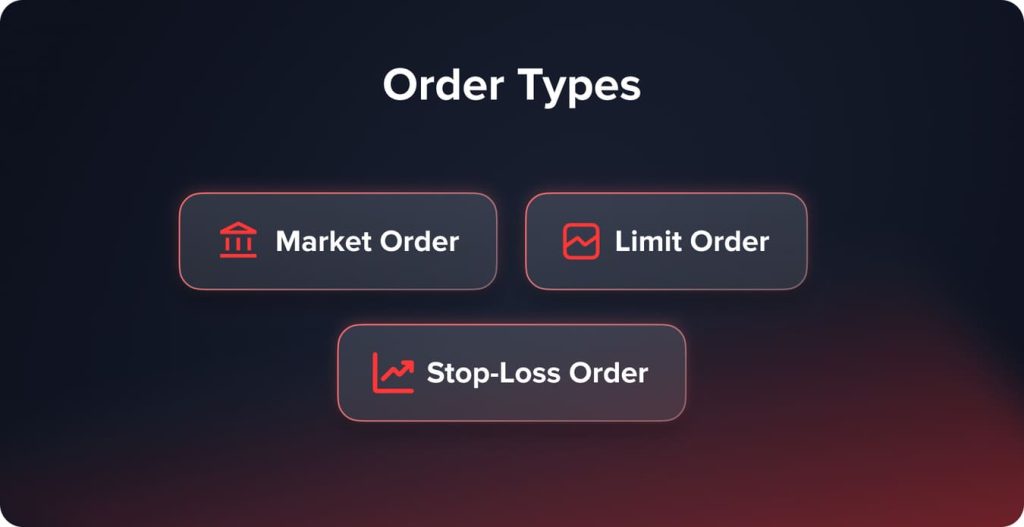

Become familiar with many order types the exchange offers. When you want to purchase or sell fast, a market order executes right at the current market price. A limit order lets you decide at whatever price you want to purchase or sell; the trade can only occur if the market gets to that level. To help in minimizing possible losses, a stop-loss order helps a position to be automatically terminated at a specified price.

Understanding how to use these order types effectively is crucial for executing your trading strategy and managing risk.

You may also like

Develop a Trading Strategy

In the cryptomarket, success relies on a properly defined trading strategy. First, specify your risk tolerance and set some financial goals. Choose between short-term trading—that is, scalping or day trading—or long-term trading using swing trading.

Finally, include technical analysis into your plan using charts and indicators to forecast market changes. Spotting trends and possible entry and exit points is possible by using candlestick patterns, moving averages, and relative strength index (RSI). Crucially, you must do deeper research to ascertain the true value of a coin. You can do this by looking at its technology, adoption rates, development team, and any relevant news or events.

Diversification is crucial as it helps traders gain access to many possible potential sources of earnings. Traders in a variety of assets or marketplaces may take advantage of numerous different chances and profit from various market moves. This approach allows for participation in the growth of multiple sectors or cryptocurrencies, increasing the likelihood of overall portfolio appreciation even if some assets underperform.

Continuously educate yourself and be prepared to adapt your strategy as you gain experience and as market conditions change.

Place Your First Trade

Choose the trading pair matching the cryptocurrency you want to acquire and the currency you are using to make your first trade.Determine the sort of order you wish to employ according to your strategy: market, limit, or stop-loss.

Enter the quantity you want to purchase or sell, then carefully go over all transaction information including the price and any fees charged. Confirm the order to execute the trade. It is advisable to start with small amounts, or even better with a demo account, to become comfortable with the trading process and to minimize potential losses as you learn.

Manage Risks Effectively

Protection of your assets and sustained long-term profitability are contingent upon good risk control. Never invest more than you can afford to lose; only utilize money you can afford to risk without compromising your essential financial duties.

Minimizing losses may be automated via stop-loss orders. Establishing a fixed price at which your position will be sold helps you to avoid major losses should the market turn against you.

Stay informed about market conditions and potential risks. Monitor news, regulatory developments, and market sentiment, as these factors can significantly impact cryptocurrency prices.

As someone just starting out, stay away from trading with borrowed money—that is, from leveraging. Leverage may rapidly cause significant debt and magnify losses.

Using these risk-reducing strategies lets you keep trading and prevent catastrophic losses.

Secure Your Cryptocurrency Holdings

Working with cryptocurrencies means giving security top priority. Consider transferring funds from the exchange to a personal wallet especially for long-term storage. Considered one of the most safe choices, hardware wallets such as Ledger and Trezor provide secure offline storage.

Protect your private keys and recovery phrases diligently. Store them safely and securely; never show them to anybody. Avoid phishing efforts and dubious communication that can try to fool you into disclosing private information.

Frequent software and device updates help safeguard against vulnerabilities. These security steps greatly lower your chances of asset theft and illegal access.

You may also like

Monitor Your Trades and the Market

Making intelligent trading decisions requires actively monitoring your transactions and being up to current on market circumstances. Reviewing your open positions on a regular basis allows you to evaluate if they are working out as intended and lets you respond quickly to changes in the market. Make use of portfolio monitoring tools that provide real-time data on your assets so you may see losses or profits and modify your approaches. Establishing price alerts also helps you to be aware of significant changes in the market, hence avoiding risks or missing valuable chances.

Apart from your own particular trades, you should monitor the entire state of the market. Remain current with industry news, legislative changes, and world economic events likely to affect cryptocurrency values. Participating in community forums and consulting reliable news sources may provide insightful analysis of market sentiment. Having an overall picture of the market helps you to predict trends, recognize fresh opportunities, and reduce the risks connected with sudden shifts in the industry.

Stay Informed and Continue Learning

The market for cryptocurrencies is very active and constantly shifting. Making smart trading decisions depends on being informed. Track reliable news sources, market analysis, and official cryptocurrency project channel updates.

Engage with the community through forums like Reddit, Twitter, and specialized discussion groups. This can provide valuable insights, different perspectives, and alerts about potential market movements.

Spend time learning by means of reading materials, webinars, and courses. Knowing blockchain technology, market psychology, and sophisticated trading methods can help you effectively navigate the market.

Being proactive in your learning helps you adapt to changes and identify new opportunities.

Understand Tax Implications

Your jurisdiction will determine if trading cryptocurrency results in taxes. Keeping thorough records of every trade you make—including dates, amounts, transaction values, and transaction purpose—is crucial.

See an accountant or tax advisor familiar with local cryptocurrency rules. Regarding capital gains, income reporting, and any relevant deductions, they may assist you with understanding your responsibilities.

Properly reporting your earnings and complying with tax laws prevents legal issues and potential penalties. Staying informed about tax regulations also allows you to plan your trading activities more effectively.

Evaluate and Adjust Your Strategy

Maintaining the effectiveness and suitability of your trading strategy depends on regular evaluation of it in relation to your financial objectives. Following a period of active trading, give some thought to your results by examining both profitable and losing transactions. List habits or tendencies that produced successful results as well as costly mistakes leading to losses. This introspective approach helps you understand the strengths and weaknesses of your strategy, providing a foundation for informed adjustments.

Long-term success in the ever changing cryptocurrency market depends on changing your approach based on these reviews. As necessary, be willing to add new tools, change your trading approach, or modify your risk-management strategies. Keep flexible in shifting market situations by always learning and being open to feedback. Over time, by honing your approach, you increase your capacity for consistent success and help yourself negotiate the complexity of trading.

Conclusion

From choosing a credible exchange to executing trades depending on a well-defined strategy, trading cryptocurrencies requires an order of deliberate decisions. Although there is profit potential, approach crypto trading carefully, sensibly, and with a long-term view. Following the advice in this resource will help novice traders lay a strong basis for their trading journey.

FAQ

Indeed, daily trading cryptocurrencies may yield $100, but it also demands substantial knowledge, expertise, and capital. The very erratic nature of the cryptocurrency market presents both significant loss risk and profit potential. Your trading approach, the state of the market, and how much money you are ready to commit will all affect your consistent earning this amount.

Because of their great market capitalization and great liquidity, cryptocurrencies such as Bitcoin (BTC) and Ethereum ( ETH) are usually recommended for newcomers. These well-known cryptocurrencies are excellent for beginners learning the foundations of trading as their price movements are more consistent than those of smaller altcoins. Beginning with well-known assets lets beginners negotiate the market with far less difficulty.

Though it comes with great volatility and risk, cryptocurrency might be interesting to consider for newcomers looking for new investing prospects. Before trading, beginners should carefully educate themselves on the operations of cryptocurrencies and blockchain technologies. Your financial objectives, risk tolerance, and willingness to spend time to study the market will determine whether or not crypto is profitable.

อัปเดต:

19 ธันวาคม 256725 มีนาคม 2568

อ่านสิ่งนี้ด้วย

อ่านสิ่งนี้ด้วยอ่านสิ่งนี้ด้วยอ่านสิ่งนี้ด้วยอ่านสิ่งนี้ด้วยอ่านสิ่งนี้ด้วยอ่านสิ่งนี้ด้วย การเทรด CFD มีหลักการทำงานอย่างไร Вот перевод вашего текста на тайский язык: Что такое Lorem Ipsum? ลอเร็ม อิปซัม (Lorem Ipsum) เป็นข้อความหลอกที่มักใช้ในงานพิมพ์และเว็บดีไซน์ โดยถือเป็นมาตรฐานสำหรับข้อความภาษาละตินตั้งแต่ศตวรรษที่ 16 ในยุคดังกล่าว ช่างพิมพ์นิรนามได้สร้างชุดแบบอักษรหลากหลายรูปแบบ โดยใช้ลอเร็ม อิปซัมเพื่อทดสอบการพิมพ์ ข้อความนี้ไม่เพียงรอดผ่านมา 5 ศตวรรษโดยไม่เปลี่ยนแปลง แต่ยังถูกใช้ในดีไซน์ดิจิทัลสมัยใหม่ ความนิยมในยุคใหม่เพิ่มขึ้นจากแผ่นตัวอย่างของ Letraset ในทศวรรษ 1960 และโปรแกรมจัดหน้ายุคหลัง เช่น Aldus PageMaker ที่ใช้ลอเร็ม อิปซัมในเทมเพลต ทำไมถึงใช้ลอเร็ม อิปซัม? มีการพิสูจน์แล้วว่าข้อความอ่านได้รบกวนการโฟกัสในการประเมินดีไซน์ ลอเร็ม อิปซัมช่วยให้เห็นการกระจายตัวอักษรและช่องว่างอย่างเป็นธรรมชาติ แทนการ重复คำว่า “ที่นี่คือข้อความของคุณ…” ซ้ำๆ โปรแกรมจัดหน้าและ HTML เอディเตอร์หลายตัวใช้ลอเร็ม อิปซัมเป็นข้อความเริ่มต้น ทำให้การค้นหาคำว่า “lorem ipsum” แสดงหน้าว่างจำนวนมากที่รอการเติมเนื้อหาจริง ตลอดปีมีเวอร์ชันหลากหลายเกิดขึ้น […]

12 มีนาคม 2568

NEW POST FOR TESTING BLOG AND WP

What is Lorem Ipsum? test link with http Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only […]