Voltar

Contents

Top 10 Options Trading Strategies

Trading

Vitaly Makarenko

Chief Commercial Officer

Demetris Makrides

Senior Business Development Manager

What is Options Trading?

Options are financial contracts that give the holder the right, but not the obligation, to sell or buy an underlying asset at a pre-determined price during a specified period. These contracts enable investors to realise one of several key investment goals: effective risk management, potential speculation on a market movement, and further income generation. Options would allow traders to gain from the same quantity of an underlying asset without having to hold the full capital required for holding the asset directly.

However, trading options also has its perils. There is time-value decay of the options contracts, changes in volatility, and finally, expiration out-of-the-money-things that may likely cause potential losses unless well managed. Hence, any options trading strategy requires thorough knowledge of underlying market dynamics, options pricing models, and principles of risk management.

Top 10 Options Trading Strategies

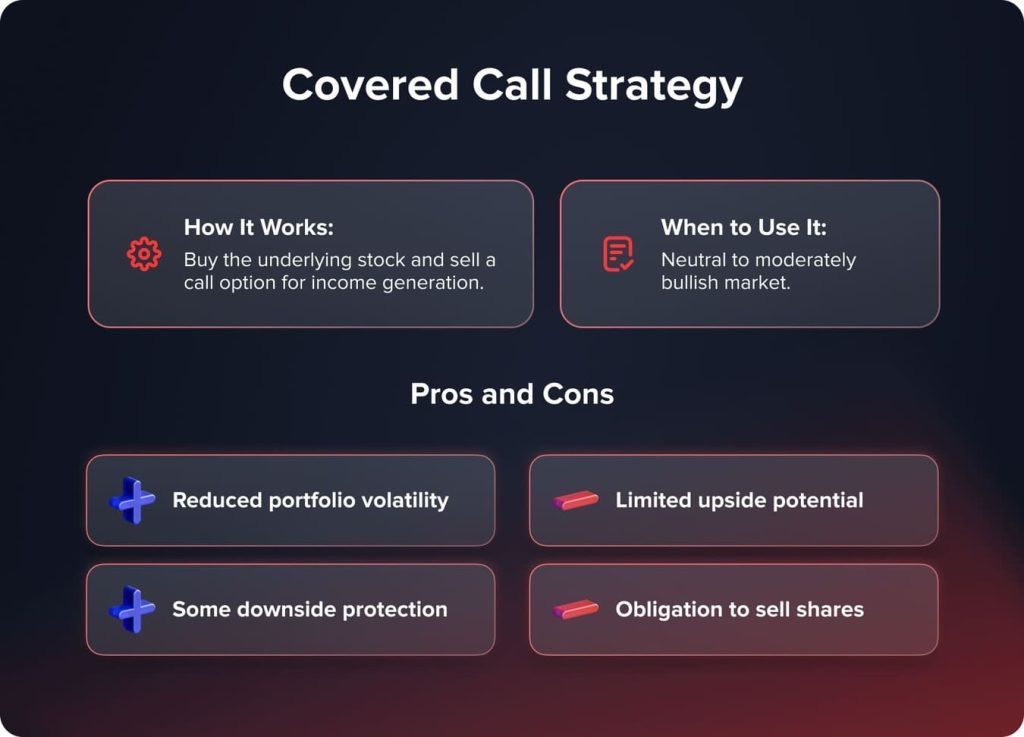

1. Covered Call Strategy

The most popular option trading strategy is that of the covered call, and it essentially represents a balance in one’s goals between income generation and the management of risk. In a covered call, one holds a long position in an underlying asset-say, a stock-and simultaneously sells a call option on the same asset.

How It Works:

In a covered call, you start off by buying the underlying shares. Following that, one sells a call option with a strike price above the current market price of the underlying asset. You collect the premium received from selling the call option. It can be a source of regular income. If at expiration the price of the underlying stock is below the strike price of the call option, then the latter would expire worthless, hence you keep the premium. In another scenario, if the stock price surpasses the strike price, then the option might be exercised, hence you will be obliged to sell your shares at the strike price.

When to Use it:

The covered call strategy is best for investors whose outlook for the underlying asset is neutral to moderately bullish. It works extraordinarily well in flat or slightly uptrending markets.

Pros vs Cons

- The pros consist of income generation, reduction in portfolio volatility, and some downside protection.

- The trade-off is that you give up upside potential in the underlying stock, in case it rises above the strike price of the sold call option.

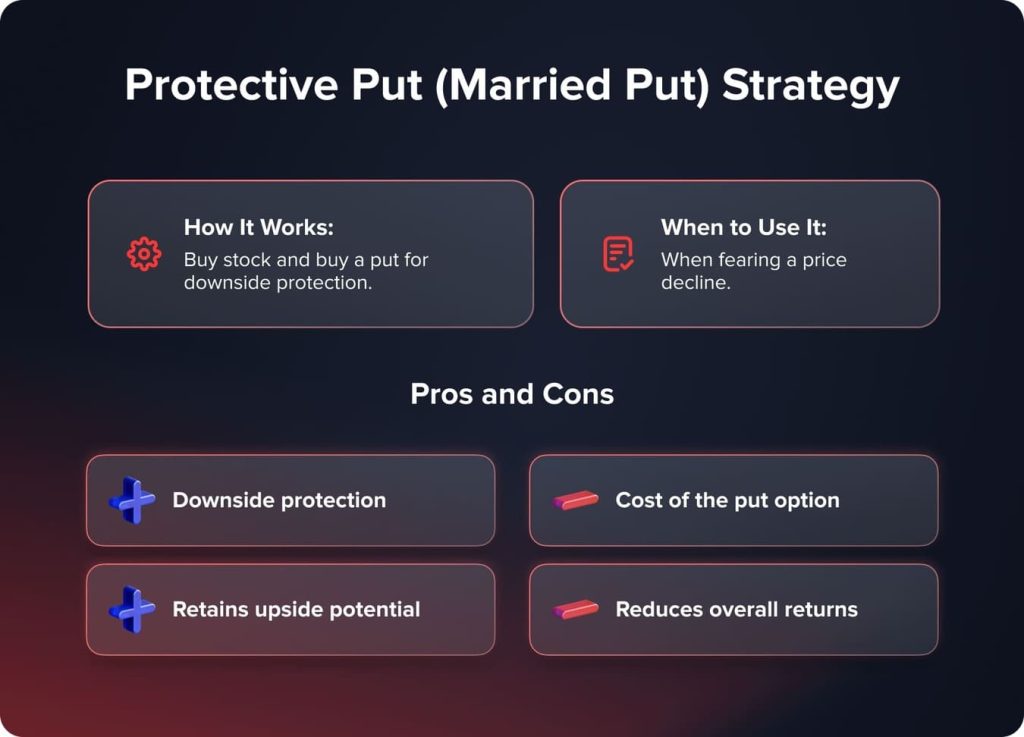

2. Protective Put (Married Put) Strategy

Protective put trade, popularly known as a married put, is an options trade strategy where one buys the underlying asset and at the same time buys a put option on that very underlying asset. It is primarily employed for the purpose of protection from downside risk in the underlying investment.

How it Works:

When buying a protective put, you first purchase a stock. You then buy one put option with the same quantity of shares as one put contract represents. The put gives you the right but not the obligation to sell the underlying at the put option’s strike price, thereby creating a floor price for your investment where the possible downside is limited to a level you can live with.

You may also like

When to Use it:

The protective put strategy is most suitable whenever one holds a long position in the underlying asset and one fears a significant decrease in the price of that asset.

Pros vs Cons

- The major positive here is the downside protection, yet the potential for upside gains can be realized.

- The offsetting factor here is the cost of the put option premium, which may eat into the overall returns.

3. Bull Call Spread

A bull call spread is one of the popular option trading strategies wherein an investor buys a call option and simultaneously sells a higher-strike call option on the same underlying asset and date of expiration. It is utilized when there is a bullish predisposition over the underlying and expects its price to rise moderately.

How it Works:

To create a bull call spread, you buy a call with a lower strike. You simultaneously sell a call on the same underlying security with a higher strike price and the same expiration date. The premium received from selling the higher-strike call partially offsets the cost of buying the lower-strike call.

When to Use it:

It is most suitable when you expect a moderate rise in the underlying asset’s price. This spreads strategy allows participation in upside potential while limiting the risk and capital outlay compared to a simple call option outright purchase.

Pros vs Cons

- The foremost advantage will be a reduced capital requirement compared to a long call position; the downside risk is limited.

- The trade-off is that upside potential is also capped at the difference between the two strike prices.

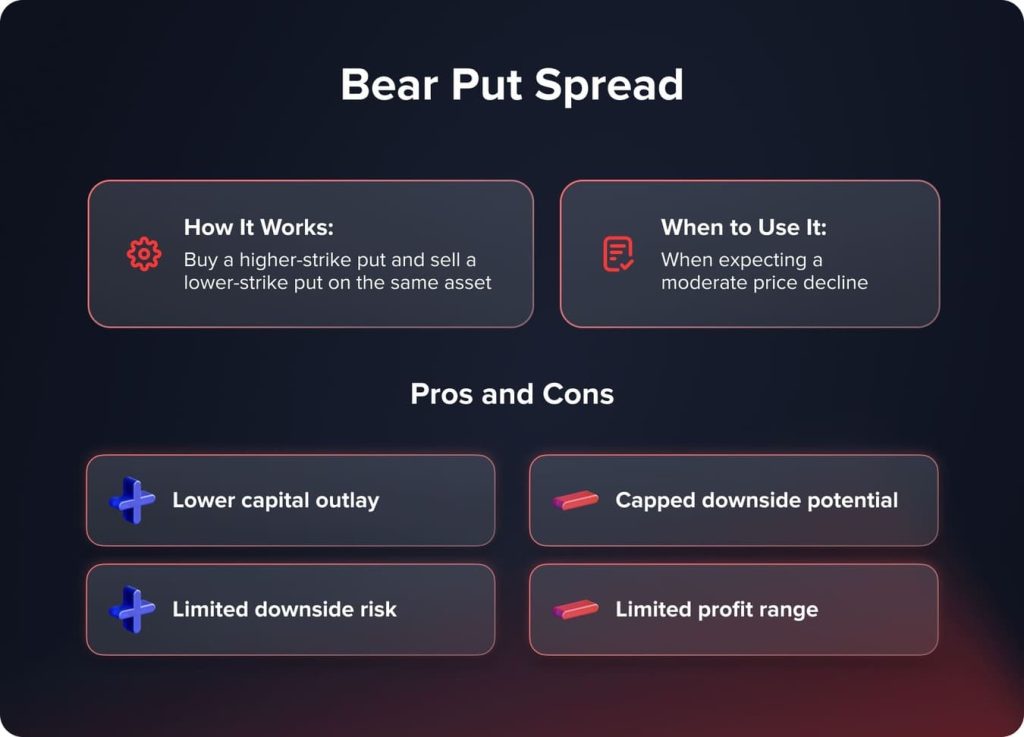

4. Bear Put Spread

The bear put spread is an options trading strategy that involves the simultaneous buying of a higher strike put option and selling of a lower strike put option on the same underlying and expiration date. This strategy is used when you are bearish on the underlying but anticipate a drop in price at a reasonable level.

How it Works:

The long bear put spread is created by buying a higher-strike put option while simultaneously selling a lower-strike put option on the same underlying and with the same expiration date. The premium received from the sold lower-strike put, when netted against buying the higher-strike put, partially offsets the cost of that higher-strike put.

When to Use it:

It is optimally utilized when one anticipates a fair amount of decline in the underlying price. This provides you with an opportunity to participate in the downside potential with limited risk and capital outlay, compared to an outright purchase of a put option.

Pros vs Cons

- The major benefit is the reduced capital requirement compared to a long put position and the limited downside risk.

- The trade-off, the downside potential is also capped at the difference between the two strike prices.

5. Protective Collar

The protective collar is an option trading strategy that involves the buying of an out-of-the-money put and selling of an out-of-the-money call on the same security. It is usually applied for protection when one already has a long position in the security concerned.

How it Works:

The protective collar is initiated by holding a long position in the underlying asset, which can be any stock. Then you buy an OTM put option. By buying the put option, one has earned the right to sell the underlying at the strike price of the put option. Sell an OTM call option simultaneously to generate income, but note that it also limits the upside potential of the underlying asset.

When to Use It:

This strategy is appropriate when one currently has a long position in the underlying asset and desires protection on one’s profits, while still achieving some upside. It is particularly helpful when markets are extremely volatile, or when one is fearful of an imminent market decline.

Pros vs Cons

- The major positive of this strategy is downside protection, with some upside participation.

- The trade-off is that the upside potential is capped by the strike price of the sold call option.

You may also like

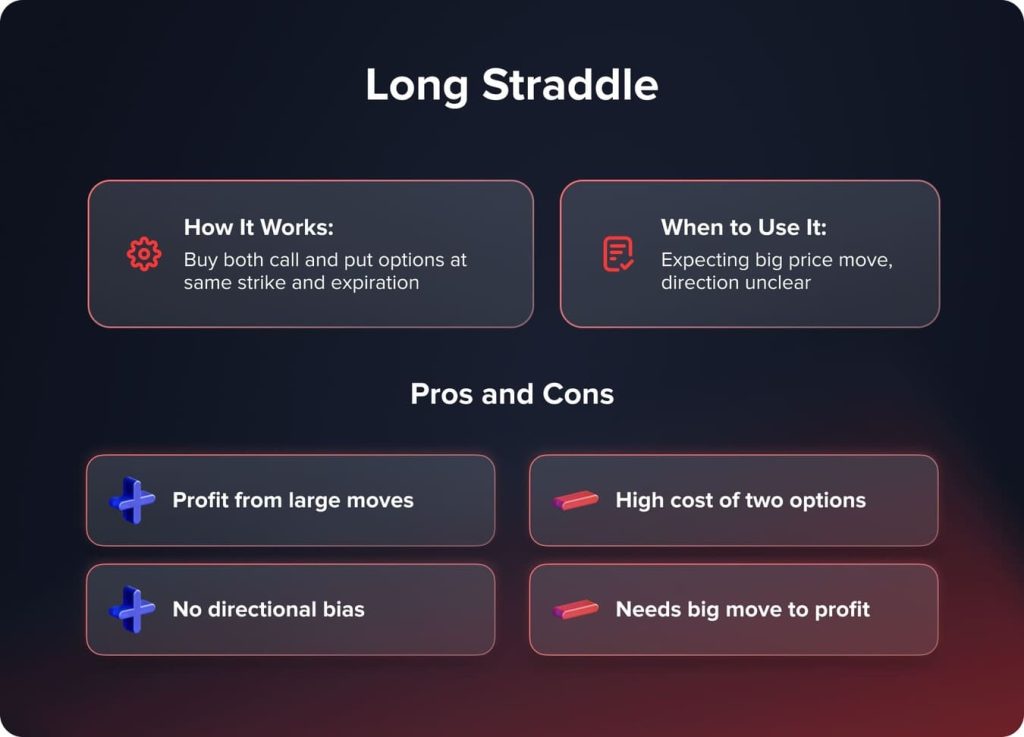

6. Long Straddle

Long Straddle Options Trading Strategy The long straddle involves simultaneously buying a call and a put option on the same security with the same expiration date and strike price. This strategy is executed when you anticipate a significant change in price movement but without any assurance of the direction in which it will happen.

How it Works:

First, to create a long straddle, one buys a call option along with a put option on the same underlying, having the same strike and expiration. This would avail him a position that profits off a large move in either direction of the price of the underlying asset, as long as the move is significant enough to cover the cost of both options.

When to Use it:

The long straddle strategy is most suitable in situations when one expects a significant change in the price of the underlying asset but is unsure of the direction of such a move. It can be around major news events like earnings announcements, regulatory decisions, or geopolitical events that are expected to drive up volatility in the underlying asset.

Pros vs Cons

- The advantage is the potential to benefit from a large move in the price of the underlying asset in either direction.

- The tradeoff is that the underlying asset’s price needs to considerably move in one of the two ways to recoup the expense of the two options.

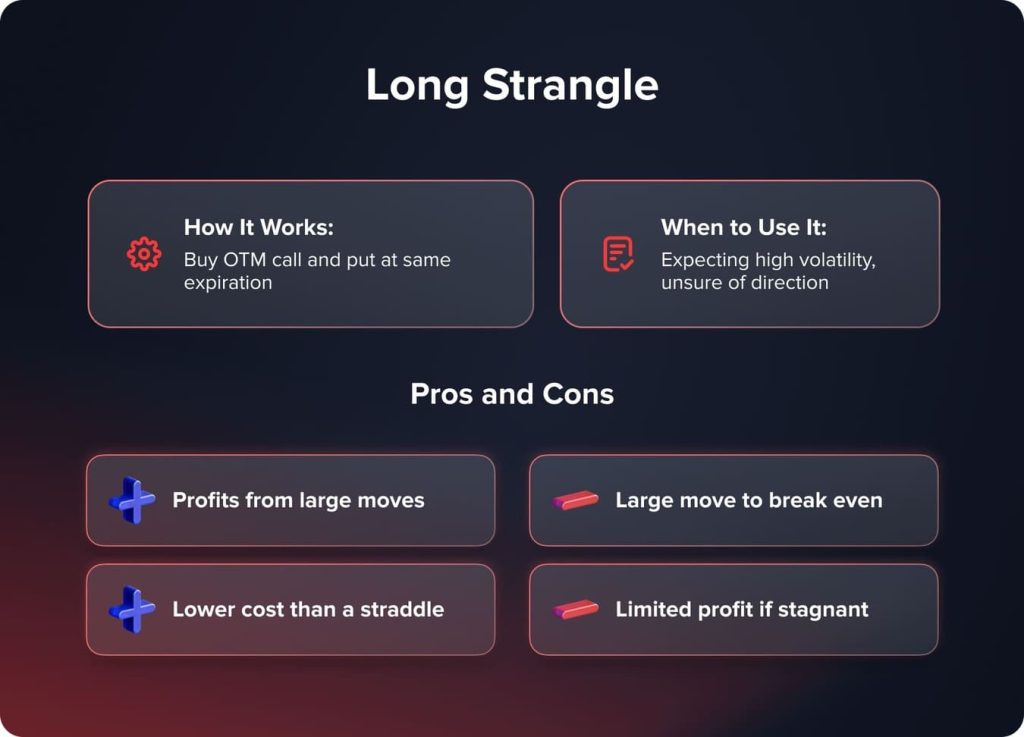

7. Long Strangle

The long strangle is an options trading strategy that involves buying an out-of-the-money call and an out-of-the-money put of the same underlying asset simultaneously. It would have the same date of expiration. This strategy is employed when one expects a dramatic movement in the price of the underlying asset but isn’t sure in which direction.

How it Works:

Start buying an OTM call option and an OTM put option on the same underlying asset with the same expiration date. The strike price of the call and put options should be as far away from the current market price of the underlying.

When to Use it:

The long strangle is most suitable when one expects a high amount of price change in the underlying asset and is unsure about the direction. This may be around big news events such as earnings announcements, regulatory decisions, or geopolitical events that are likely to drive increased volatility in the underlying asset.

Pros vs Cons

- The primary advantage here is that you can potentially profit from a big move either up, or down in the price of the underlying.

- The trade-off is that the underlying needs to move enough in one of the two directions to compensate for the expense of the two options involved.

8. Butterfly Spreads

Butterfly spreads are a group of options trading strategies involving the simultaneous sale and purchase of call options or put options, only differing in their strike prices, on the same underlying and having the same expiration date. These strategies are generally employed when one wants to take advantage of minimal or range-bound price action in the underlying.

How it Works:

There are primarily two types of butterfly spreads: long call butterfly and long put butterfly. In a long call butterfly, one lower-strike call option is bought, two at-the-money options are sold, and one higher-strike option is bought off the same call series. On the other hand, for a long put butterfly, the positions would be flipped around with the put options.

When to use it:

Butterfly spreads are most suitable when you expect the price of the underlying asset to remain relatively stable or trade within a narrow range. They can be used to generate income or capture limited upside/downside movements.

Pros vs Cons

- The big positive is that you can generate an income and profit if the underlying stock continues to trade within a particular range, with defined risk.

- The catch is that your upside and downside potential is capped too.

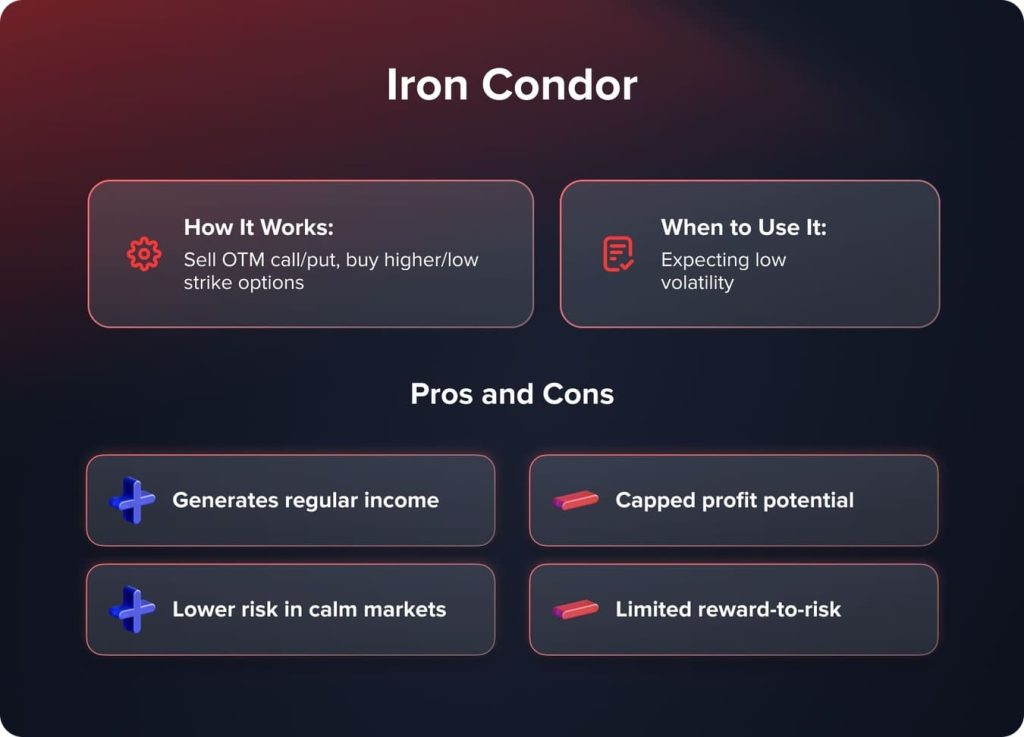

9. Iron Condor

The iron condor is a derivatives trading strategy that consists of simultaneously taking positions in buying and selling of both calls and puts having different strikes but with the same expiration date on the same underlying instrument.

How it Works:

It is achieved by selling an OTM call and an OTM put, and simultaneously purchasing an OTM call with a higher strike and an OTM put with a lower strike. This results in a position that is neutral regarding the price of the underlying asset.

When to Use it:

It is most applicable when you anticipate the price of the underlying to trade within a certain range with low volatility. This can be utilized to take in income and also to exploit market conditions when volatility is expected to be low.

Pros vs Cons

- The major benefit is the ability to generate regular income from range-bound or low-volatility market conditions.

- The trade-off is that the upside and downside potential are capped.

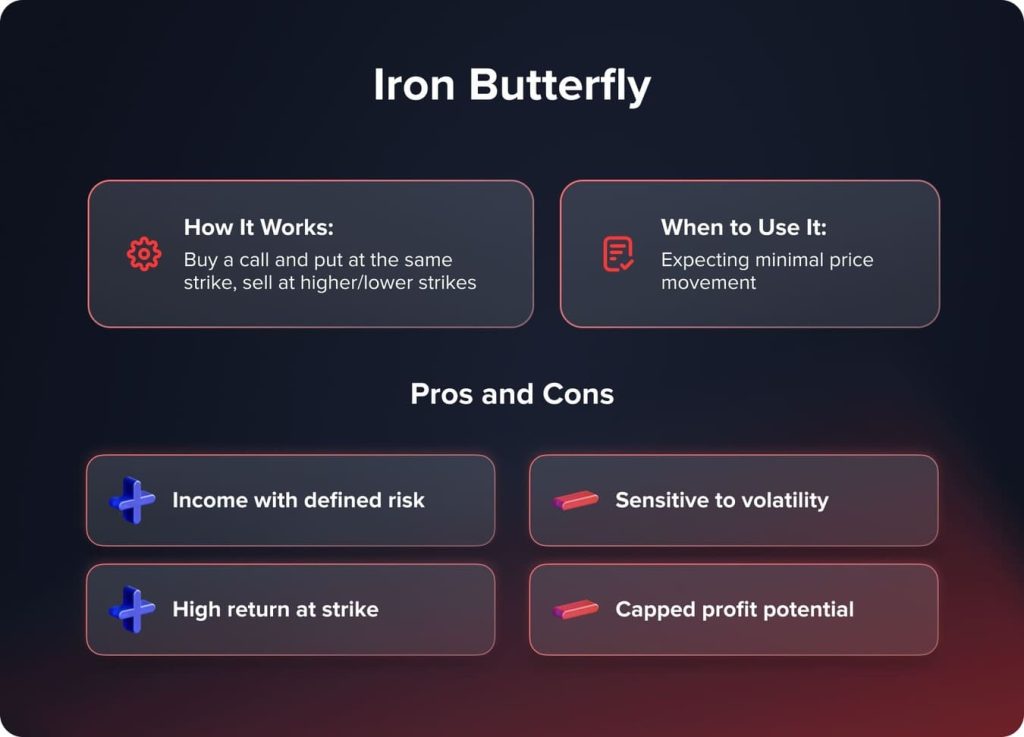

10. Iron Butterfly

It differs from the iron condor only in the fact that an iron butterfly’s bought call and put options are at the same strike price, which would serve as the middle of the two sold options. This will lead to a position far more sensitive to changes in implied volatility.

How it Works:

The iron butterfly is similar to the iron condor but with one key difference. An iron butterfly consists of simultaneously buying and selling both call and put options, but the bought call and put options are at the same strike price, which serves as the middle of the two sold options. This structure makes the iron butterfly more sensitive to changes in implied volatility compared to the iron condor.

When to Use it:

It is best utilized when the trader expects the underlying asset to trade within a certain range with low volatility. It can be used to generate income and take advantage of low-volatility market conditions.

Pros vs Cons

- The major benefit of this strategy is that one is able to attain regular income from range-bound or low-volatility market conditions with defined risk.

- The trade-off is that it is more sensitive to changes in implied volatility compared to the iron condor.

Conclusion

Therefore, the key to options trading lies in understanding not only the mechanics of each strategy but also the risk-reward profiles and use cases. Only then can you position your options accordingly to be in tune with your market outlook, your risk tolerance, and your investment objectives. As you practice these strategies, bear in mind the importance of carefully evaluating the underlying asset’s price action, volatility patterns, and other catalysts that may lead to sharp price movements.

FAQ

The covered call strategy allows for consistent income generation by selling call options against owned shares. This provides a premium collection while maintaining the underlying investment.

Protective puts, covered calls, and collars are three of the most basic and commonly used options strategies by traders.

Developing discipline is essential for options trading success. This includes thorough research, identifying opportunities, setting up trades properly, sticking to a strategy, setting goals, and having an exit plan.

Atualizado:

19 de dezembro de 2024

12 de março de 2025

NEW POST FOR TESTING BLOG AND WP

What is Lorem Ipsum? test link with http Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only […]