Voltar

Contents

How To Start A Brokerage Firm? — Comprehensive Guide

Brokerage Business

Vitaly Makarenko

Chief Commercial Officer

Iva Kalatozishvili

Business Development Manager

The international world we live in now makes financial markets easier to get to and more appealing than ever. With new asset classes like cryptocurrencies and the Forex market’s constant draw, the desire to expedite trade and profit from the hype is evident. Brokerage firms, both traditional ones and those that focus on new asset classes, play a big role in this changing world, and starting your own brokerage may be a good way to make money.

An Overview of the Brokerage Firms

In the ever-evolving financial landscape, several brokerage archetypes have emerged, each catering to distinct investor needs and preferences. Let’s explore these types in detail.

Full-service Brokerages

Often, full-service brokerages are seen as the giants of the brokerage system. From customized guidance to portfolio management, they provide a complete set of financial services. Usually on a worldwide basis, these companies have a broad operations scope and attract high-net-worth people and organizations as their clients. Their devotion to individualized service distinguishes them. Every customer benefits from committed financial professionals who actively manage and reallocate assets. This is complemented by the firm’s exhaustive research and analytics division, producing in-depth market reports and insights.

Discount Brokerages

On the opposite side of the spectrum are discount brokerages, mostly geared at the contemporary, tech-savvy investor. Efficiency and economy come first on these sites. Although they provide the basic instruments for self-directed trading, they exclude the extra layers of guidance that are usually associated with their full-service equivalents. Their user-friendly interfaces, use of sophisticated charting tools, and – in certain cases – robo-advisor guidance of investment choices highlight their digital-first strategy.

Forex Brokerages

Turning towards the specialized domain, Forex brokerages become gatekeepers to the biggest financial market in the world. Running around-the-clock, this market attracts investors eager to make money off of changes in value of money. With their great leverage, these brokerages enable traders to control much more than their original funds would allow. Here, trading is unique, emphasizing pairings of currencies like the EUR/USD or GBP/JPY. Understanding the complexities of this market, several Forex brokerages also provide traders with instructional tools to help them to hone their trading abilities.

Crypto Brokerages

Crypto brokerages have found their place at the advent of the digital age, acting as the hub between conventional finance and the avant-garde realm of cryptocurrency. As Bitcoin climbed, a new era started, and these brokerages have been crucial in providing access to this fast growing asset class. They provide a broad spectrum of digital assets, including several cryptocurrencies beyond the well-known Bitcoin and Ethereum. Priority is security, which drives many to use cold storage to guarantee that a good chunk of their digital assets stay free from internet weaknesses.

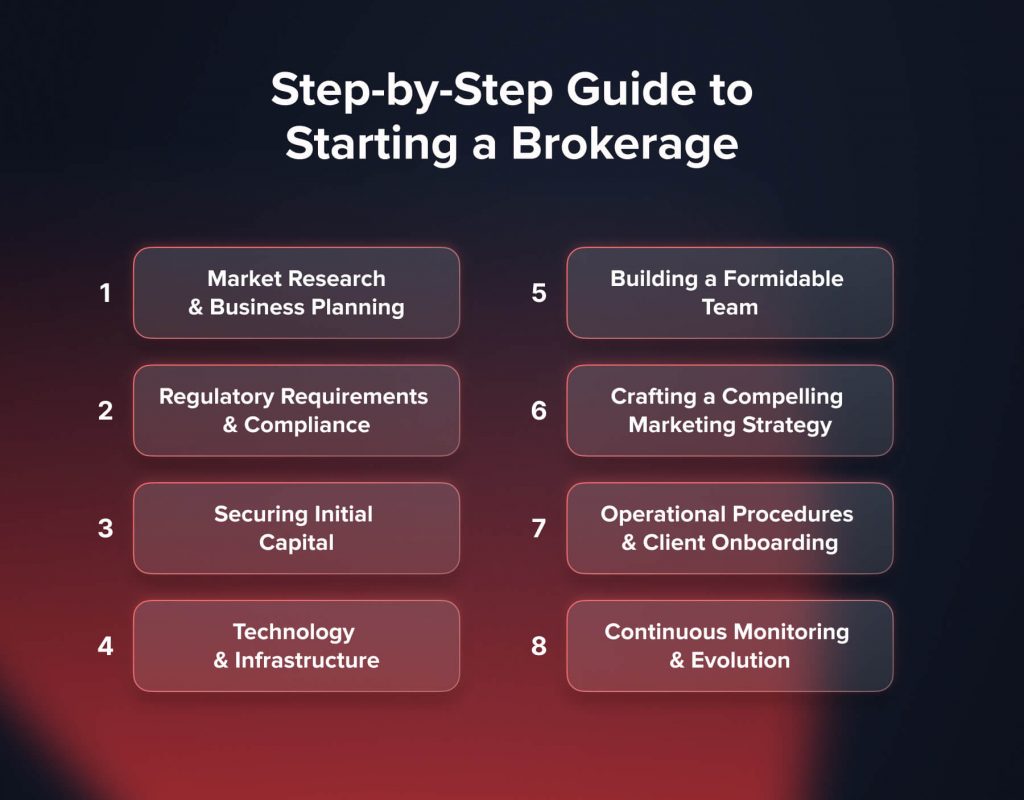

Step-by-Step Guide to Starting a Brokerage

Entering the brokerage sector calls for careful preparation, knowledge of regulatory environments, and a calculated attitude to market positioning. The journey is thoroughly walked through here:

1. Market Research & Business Planning

One really must have a strong awareness of the market before entering the brokerage field. Start by identifying a niche that clearly meets a market demand and fits your experience. Forex and cryptocurrencies may provide interesting prospects given their appeal, but they also have own set of difficulties. Know the dynamics of your selected niche and the profile of your possible customers.

With a niche identified, the next step is sculpting a robust business model. This is where you decide the breadth of services you’d offer. Are you leaning towards a full-service model, or do you see merit in the efficiency of a discount brokerage? Your fee structure, risk management strategies, and technology platforms are also key decisions at this stage.

A SWOT analysis can be a potent tool during this phase. Analyzing your strengths, shortcomings, prospects, and hazards helps you not only recognize possible obstacles but also position you to profit from market gaps.

2. Regulatory Requirements & Compliance

Like all other financial endeavors, brokerages follow a set of rules. These guidelines exist to ensure integrity of the financial system, consumer protection, and openness.

The landscape varies across jurisdictions. SEC and FINRA lead US regulatory agencies. ASIC oversees in Australia, whereas the FCA oversees in the UK. Because of its effect on Forex broker laws, Cyprus’ CySEC is noteworthy in the Forex industry.

Delving into these regulatory bodies’ requirements is paramount. This includes getting required permits, implementing strict Know Your Customer (KYC) policies, and guaranteeing adherence to Anti-Money Laundering (AML) rules. Especially in the fields of Forex and cryptocurrencies, compliance cannot be a secondary priority. It’s foundational.

3. Securing Initial Capital

Capital is the lifeblood of any business venture, and brokerages are capital-intensive by nature. The requirements can differ, with Forex and crypto brokerages often demanding substantial initial capital to cushion against market volatilities. Traditional avenues like bank loans are an option, but in the age of fintech, innovative funding solutions are emerging, from venture capital injections to crowdfunding platforms.

4. Technology & Infrastructure

In an age where trades occur in milliseconds, cutting-edge technology is not a luxury; it’s a necessity. Your technological backbone will define the trading experience for your clients, especially in high-frequency arenas like Forex and crypto. Collaborating with established technology solution providers can offer a competitive edge. Data security, given the digital nature of transactions today, is another paramount consideration.

You may also like

5. Building a Formidable Team

The crux of your brokerage’s operations lies in the hands of your team. While your vision is the guiding force, the team transforms this vision into a reality. At the pinnacle are your executives, individuals whose seasoned expertise and industry connections help traverse the multifaceted financial landscape. These leaders don’t merely make decisions; they lay the foundation for the firm’s ethos and direction.

The granular analysis of market trends and financial data falls to the analysts. Their dedication to understanding market movements and crafting informed perspectives can make the difference between an ordinary and an outstanding brokerage, especially if you’re leaning towards a comprehensive service offering.

But a brokerage in the modern era isn’t just charts, trends, and financial strategies. The digital platform you offer clients is the interface of your service. This makes IT specialists the cornerstone of your operations. Their role transcends maintaining servers. They ensure every client has a seamless trading experience while simultaneously fortifying your digital assets against threats.

Of course, while technology is pivotal, the human touch remains irreplaceable. Here’s where your customer support steps in, bridging the gap between digital efficiency and human empathy. Their interactions, guidance, and problem-solving skills reflect the firm’s commitment to its clientele.

And amidst this vast machinery, someone needs to ensure that the gears turn smoothly, in sync with the legal and regulatory beat. Compliance officers wear this hat. Their unyielding focus on regulatory adherence ensures that while the firm scales heights, it always remains grounded in legal integrity.

6. Crafting a Compelling Marketing Strategy

Once your infrastructure is solidified, it’s time to illuminate your brand in the financial market’s spotlight. Your brand isn’t just a logo or a tagline; it’s a promise to your clients. The visual and tonal elements should echo trust, expertise, and innovation.

In the age of digital dominance, your online presence speaks volumes. Strategic digital campaigns, insightful blog posts, and active social media engagement aren’t just boxes to check; they’re pathways to nurture relationships with your audience.Furthermore, knowledge is currency in the financial world. Providing instructional materials such seminars, webinars, and e-books not only strengthens the power of your brand but also builds a knowledgeable and devoted customer base. View this useful webinar, which offers thorough insights and useful guidance on negotiating the complexity of the brokerage industry, for individuals interested in a more in-depth conversation on launching a brokerage. This extra tool seeks to deepen your knowledge and help you to build a strong basis for your business.

7. Operational Procedures & Client Onboarding

Seamless operations are the silent, yet powerful, drivers behind a successful brokerage. Every trade execution, every financial strategy recommendation, and every client interaction needs to be refined to perfection. This operational finesse ensures that clients aren’t just satisfied; they’re delighted.

But before clients delve deep into financial strategies, they undergo the onboarding process. This initiation should be swift yet thorough, using digital tools to expedite processes while ensuring stringent KYC procedures are uncompromised.

8. Continuous Monitoring & Evolution

Financial landscapes are dynamic, and resting on laurels isn’t an option for a brokerage with aspirations. Stay attuned to market shifts, be it technological innovations or changing investor sentiments. Regular market surveillance, feedback loops with clients, and an unyielding focus on improvement ensure that your brokerage doesn’t just exist; it thrives.

Challenges to Anticipate

Starting a brokerage isn’t a straightforward voyage. It’s marked with complex challenges that test not only your industry expertise but also your strategic acumen. Here, we delve deeper into some of these challenges and the intricacies they bring forth:

The Dynamic Regulatory Landscape of the Forex and Crypto World

Negotiating the financial seas of Forex and cryptocurrencies involves walking on continuously shifting ground. Globally, regulatory authorities are always changing their structures to fit changes in the market, new technology developments, and the global socio-economic climate. For instance, while a jurisdiction may be crypto-friendly today, policy changes influenced by market incidents or shifts in government can swiftly change that stance.

Additionally, the decentralized nature of cryptocurrencies often brings them under heightened scrutiny. Many regulatory bodies grapple with classifying them: Are they assets? Commodities? Currencies? Each classification carries its set of compliance requirements. Keeping up with this always changing tapestry as a developing brokerage is not just about legality but also about preserving the confidence of a customer base looking for guarantees in your compliance.

Technological Advancements: The Double-Edged Sword

Technology has several drawbacks even if it is clearly a benefit as it improves trade speeds, simplifies procedures, and increases access. On one side, technology like blockchain and artificial intelligence seem to transform transaction transparency and trade strategies. Conversely, they show security flaws because hackers are becoming more advanced.

Brokerages today aren’t just battling market volatilities; they’re also constantly fortifying their digital ramparts. Every technical development – from a client site to a trading algorithm – must be considered in relation to any security risks, so ongoing innovation and protection must be balanced.

You may also like

Standing Out in a Crowded Marketplace

The allure of Forex and crypto has ushered in a plethora of brokerages, each vying for a slice of the lucrative financial pie. In this bustling marketplace, differentiation becomes paramount. But carving a niche is easier said than done.

It’s about creating a unique value offer, not just about sophisticated trading systems or competitive charge policies. Whether your emphasis is on sustainable investments, first-rate instructional materials, or innovative technology, identifying and enhancing your unique selling point in a crowded field becomes a difficult but necessary task.

The Unpredictability of Crypto Markets

Traditional financial markets are like rivers with their ebbs and flows; crypto markets are more like stormy seas. Their volatility is legendary. Prices may rise or fall in minutes depending on everything from government announcements to technology breakthroughs to tweets from powerful people.

For brokerages, this unpredictability isn’t just a trading challenge; it’s a reputational one. Guiding clients through these tumultuous waters means not just offering strategic advice but also managing expectations, ensuring risk literacy, and cultivating trust. The goal is to position oneself not as a mere transactional platform but as a guiding beacon amidst the crypto storm.

Anticipating difficulties is about preparedness rather than fostering despair. As the proverb says, “Forewarned is forearmed.” Knowing these difficulties, brokerages may plan, adjust, and finally flourish, transforming possible obstacles into stepping stones towards new success.

Reaping the Rewards of a Well-Strategized Brokerage Venture

Starting and running a profitable brokerage in the complex sectors of Forex and cryptocurrency is not for the weak of stomach. It calls for careful preparation, a relentless dedication, and the capacity to move to the always changing notes of the financial symphony. For those that find the correct chords, however, the benefits are great in terms of revenue as well as the satisfaction of leaving a major mark on the financial scene.

Every informed decision, every technological innovation incorporated, and every trust bridge built with clients culminates into a thriving brokerage venture. But this success isn’t just gauged by numbers on a profit statement. It’s reflected in the trust of clients who look to your platform for guidance, the respect of peers who acknowledge your industry contribution, and the satisfaction of a team that finds purpose in its roles. The journey to establish a brokerage is intense, but the horizon of possibilities it opens up is nothing short of exhilarating.

Conclusion

In the always changing realm of finance, success calls not just for strategy but also a dedication to lifelong learning to guarantee brokerages stay flexible and ahead of their time. Whether they address market trends, technology developments, or legislative changes, brokerages that support a culture of lifelong learning set themselves not just as market participants but also as market leaders.

Starting a brokerage is like composing a masterpiece in the grand orchestra of finance. With the right notes of preparation, strategy, and adaptability, the music isn’t just harmonious; it’s legendary. Embarking on this journey with a clear vision, unwavering commitment, and an adaptable strategy ensures that the financial ocean’s vastness, with its challenges and opportunities, becomes a thrilling adventure, waiting to be navigated.

Atualizado:

18 de dezembro de 2024

12 de março de 2025

NEW POST FOR TESTING BLOG AND WP

What is Lorem Ipsum? test link with http Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only […]