Voltar

Contents

Heikin Ashi Candles: Definition, Overview, How to Use

Vitaly Makarenko

Chief Commercial Officer

Demetris Makrides

Senior Business Development Manager

Heikin Ashi is an indicator based on specific candles that differ from traditional Japanese candlesticks in brighter visualization. Traders use Heikin Ashi candlesticks to get a stronger signal that informs them about a possible trend change.

How does the indicator work, and what are the main trading strategies based on Heikin Ashi candlesticks?

The History of the Heikin Ashi Indicator

The term “Heikin Ashi” means “bar in the middle/average bar” when translated from Japanese. Such an indicator appeared in the 1700s and the creator of Heikin Ashi candles was Munehisa Homma, a rice merchant from Sakata. Munehisa introduces the traditional candlestick chart as well; which is why Heikin Ashi is understood as a reorganized version of Japanese candlesticks.

The Differences between Heikin Ashi Candles and Japanese Candlesticks

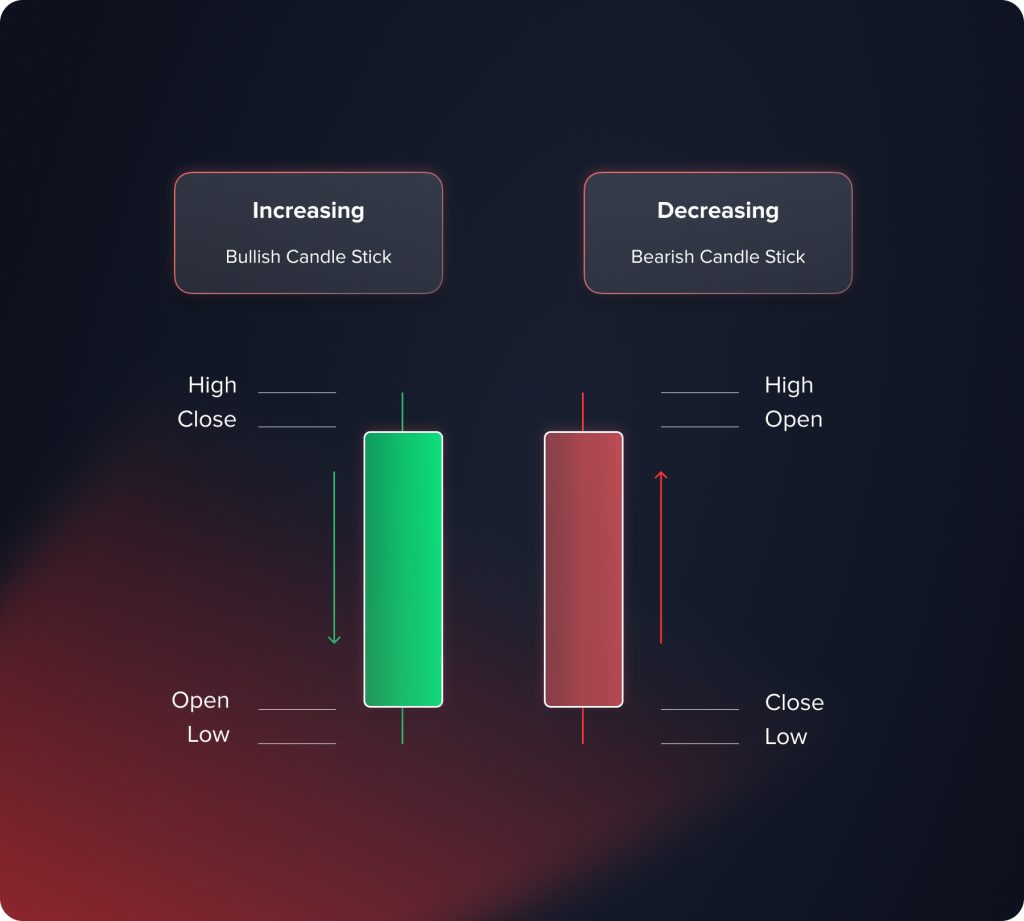

A traditional Japanese candlestick provides traders with the following information:

- open price;

- close price;

- minimum price;

- maximum price.

Open and close prices are represented by a candlestick’s body and the shadows mark the minimum and maximum prices within a certain timeframe.

When the market experiences high volatility, bullish and bearish candles alternate on the chart, and such alternation makes it exceptionally difficult to define what the current trend is. Modified Heikin Ashi candles solve this problem.

Instead of indicating open, close, minimum, and maximum prices, Heikin Ashi represents the average meanings of all the indicators.

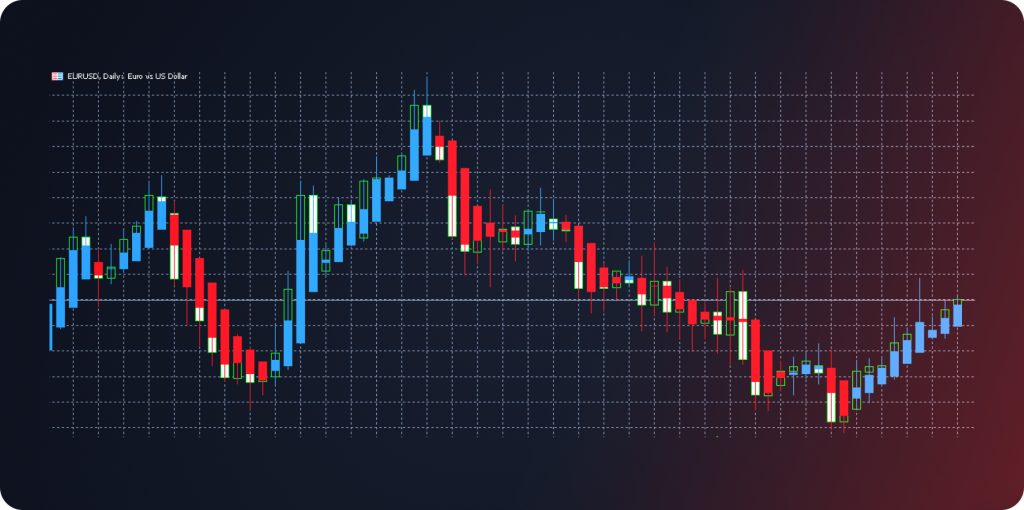

The following image illustrates how traditional candlesticks and Heikin Ashi are built for the EUR/USD chart (D1 timeframe). Heikin Ashi candles are smoother. There are no gaps, and traders may ignore market noises.

Heikin Ashi candles are built according to the following formula:

- Open price = (open price of the previous bar + close price of the previous bar) / 2;

- Close price = (open price + maximum price + minimum price + close price) / 4;

- Max price = (the highest price taken from max, open, or close price);

- Min price = (the lowest price taken from min, open, or close price).

Traders frequently compare the Heikin Ashi indicator with Moving Averages, as both instruments provide traders with smooth market data ignoring short-term volatility and noises.

Heikin Ashi Signals

Using Heikin Ashi candles traders get the following important information: the direction of the current market trend, its initial and ending points; which is why, they can either open or close positions. How to identify signals based on this indicator?

- When an asset’s price is steadily rising or falling, the minimum and non-existent shadows are important indicators of an on-going trend. For instance, on the bullish market Heikin Ashi candlesticks have minimum or non-existent lower shadows, and vice versa.

- The bar opening level is another important indicator. When a certain trend dominates on the market, a new candlestick usually opens in the middle of the previous bar.

- The color of candlesticks should be taken into account as well. Heikin Ashi uses smooth market data; this is why the domination of blue (green) candles informs about the bullish trend when the domination of red candles states the bearish trend.

The size of candles help traders understand how strong the current trend is. When the body of every next candle is bigger than the previous one, the strength of a trend rises. Decreasing of candle sizes indicates the reduction of a trend’s strength and its possible reversal.

Let’s apply the above-mentioned signals to a real chart. As an example we use the XAU/USD (gold Vs US dollar) chart.

When the bearish trend dominates the market, red candles have minimum or non-existent upper shadows. When the upper shadow appears, the trend loses its strength which means the possible reversal. Furthermore, Heikin Ashi candles show traders more precise price movement. On a traditional chart we see the combination of bullish and bearish candlesticks when candles of the Heikin Ashi instrument are strictly bullish or bearish.

Heikin Ashi Patterns

Chart patterns are among the most widely used instruments that help traders understand the very best moment to enter the market. When talking about Heikin Ashi candles, the patterns are more precise signals. What are the most widespread and useful chart patterns?

Doji

When the open and close prices are equal, the Doji pattern appears. A candle has a non-existent body represented by a horizontal line and long upper and lower shadows. The pattern shows that neither bulls nor bears dominate. Doji falls into the category of reversal patterns – when it appears at the end of the bullish market, traders open short positions, and vice versa.

Harami Cross

Such a pattern consists of two candles and represents the category of reversal patterns as well. The Harami cross includes two candles of different colors. The first candlestick has a big body when the next candlestick resembles the Doji pattern. The only difference lies in that the Harami cross has a minimum body, not just a horizontal line. Note that the shadows of the second candle should not cross the shadows of the previous one. When the Harami cross appears on the chart, traders should be ready for a trend reversal.

Hammer / Hanging Man

This candlestick pattern consists of a candle that has a minimum body, minimum or non-existent upper shadow, and long lower shadow. Graphically the pattern resembles a hammer. When the pattern appears in the bullish market, it is called the Hanging man. When a trader identifies the hammer (hanging man) pattern, they open positions in the opposite directions.

Shooting Star

This chart pattern appears in the bullish market and indicates the nearest reversal. The Shooting star has a long upper shadow that is bigger than a candle’s body at least twice. A lower shadow should be absent or minimum (less than 10% of a body). The candle is always blue (green). When the Shooting star appears, traders open short positions.

High-Wave

High waves are candles with long upper and lower shadows that are of the same size. Such candles play the same role as the Doji pattern does. High waves indicate that the market experiences the balance between bulls and bears; which is why the previous trend loses its strength.

How to Use Heikin Ashi to Identify the Current Trend?

Experienced traders activate the Heikin Ashi instrument to identify the current market trend. The following factors are of much account:

- the length of a candle’s body and how it changes;

- the ratio of a candle’s body and shadows;

- the dominating type of candles (bullish or bearish);

- the price movement direction.

Let’s understand how to utilize the mentioned factors to identify bullish and bearish trends.

The Bullish Market Trend (According to Heikin Ashi)

The following markers inform a trader that the bullish trend dominates on the market:

- The price is going higher.

- Green (blue) bullish candles are dominating on the chart.

- When the bodies of bullish candles get bigger, the strength of the bullish trend grows. When their bodies get smaller, the trend loses its strength.

- Minimum or no lower shadows indicate the strong bullish trend.

The Bearish Market Trend (According to Heikin Ashi)

The following markers inform a trader that the bearish trend dominates on the market:

- The price is going lower.

- Red bearish candles are dominating on the chart.

- When the bodies of bearish candles get bigger, the strength of the bearish trend grows. When their bodies get smaller, the trend loses its strength.

- Minimum or no upper shadows indicate the strong bearish trend.

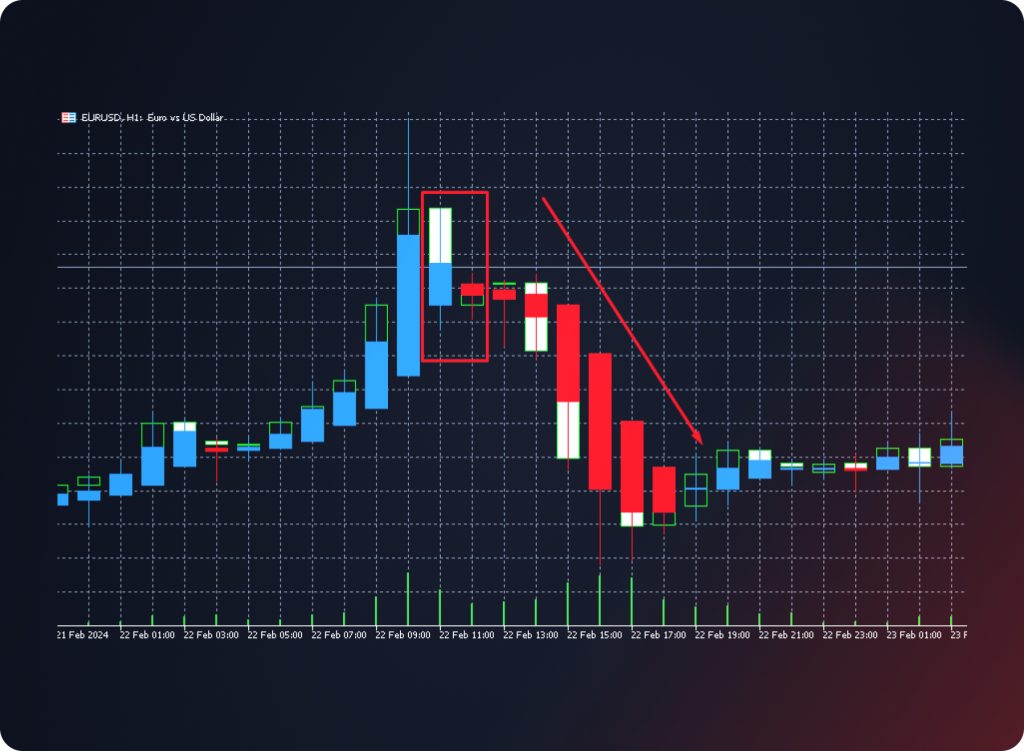

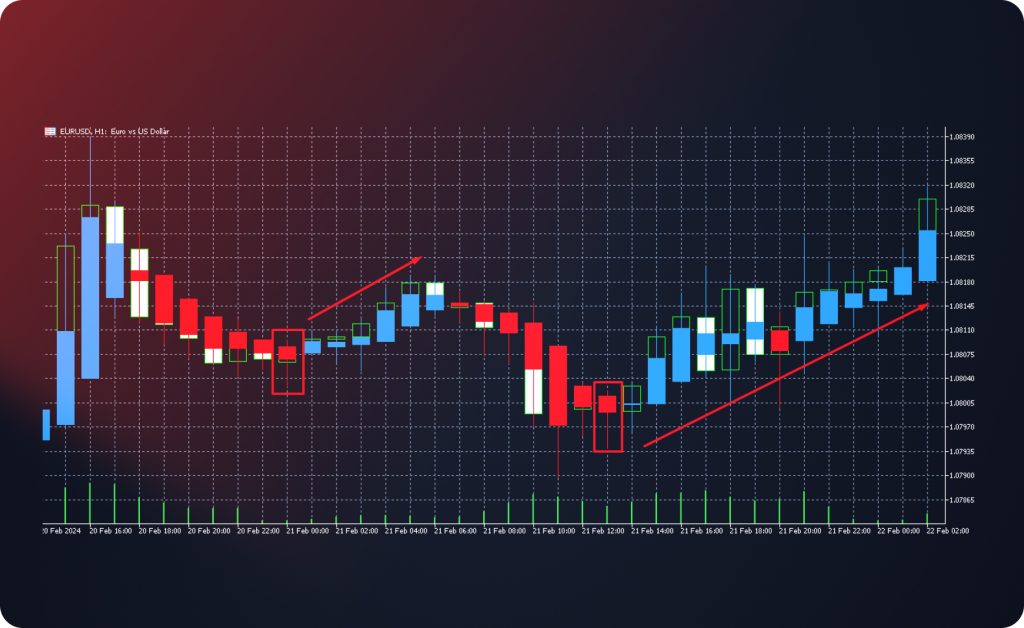

Trend Analysis Based on Heikin Ashi Candles (GBP/USD Currency Pair)

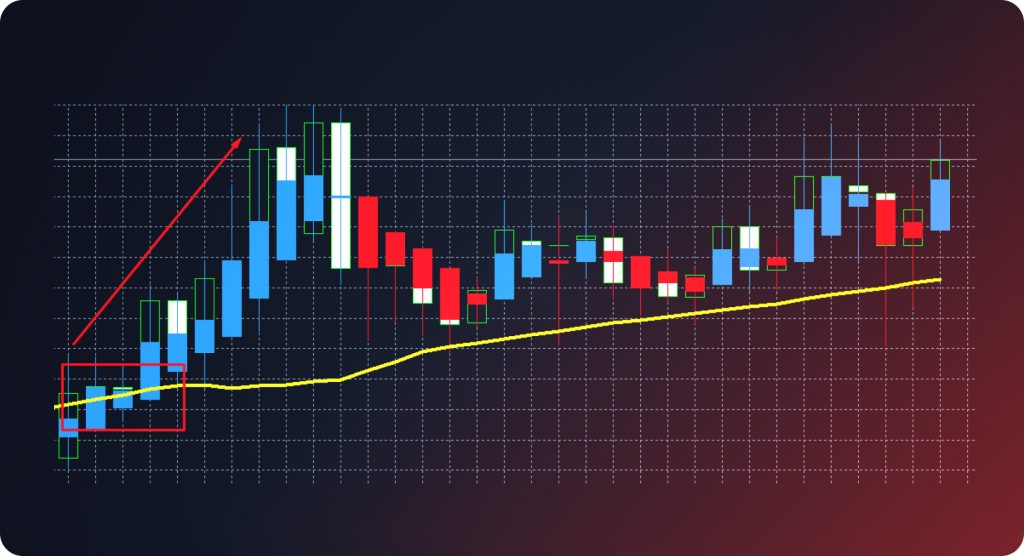

Let’s illustrate the above-mentioned information by the example. The Heikin Ashi indicator is applied to the GBP/USD chart to understand what is the current market trend and how strong it is.

The blue candles let us understand that the bullish trend dominates the market. The candles have no lower shadows; therefore, the trend is rather strong. On the other hand, candle bodies increase in sizes up to the 5th candle, and then bodies are getting smaller. Such a tendency may indicate that the bullish trend becomes weaker.

Heikin Ashi is a useful indicator but experienced traders combine it with other instruments to get more precise signals.

The Combinations of Heikin Ashi with Other Technical Analysis Instruments

The Combination of Heikin Ashi and Moving Average

Some traders combine Heikin Ashi with momentum indicators. For instance, you may add the Moving Average indicator to the chart (the SMA line with the period of 50). When a Heikin Ashi candle crosses the SMA 50, you may open a position:

- Open a long position when a green (blue) Heikin Ashi candle crosses the SMA 50 line from the bottom up.

- Open a short position when a red Heikin Ashi candle crosses the SMA 50 line from the top down.

The Combination of Ichimoku Cloud and Heikin Ashi

Add the Ichimoku cloud to the chart using default settings (9, 26, 52). The following conditions should be taken into account when entering the market:

- Open a long position when a candle leaves the Kumo cloud and closes above the cloud. Tenkan Sen is higher than Kijun Sen. Chikou Span is higher than the price chart and belongs to the rising trend. Senkou Span A is higher than Senkou Span B. A Heikin Ashi candle is bullish (green or blue).

- Open a short position when a candle leaves the Kumo cloud and closes below. Tenkan Sen is lower than Kijun Sen. Chikou Span is lower than the price chart and belongs to the falling trend. Senkou Span A is lower than Senkou Span B. A Heikin Ashi candle is bearish (red).

The Pros and Cons of the Heikin Ashi Indicator

The advantages of Heikin Ashi are as follows:

- The indicator is based upon a simple and effective visual system.

- Such an indicator is a perfect solution for long timeframes.

- Heikin Ashi candles are easily defined by color, and traders do not need to remember complicated combinations.

The cons of Heikin Ashi are the following ones:

- The indicator doesn’t match the impulse trading style.

- Heikin Ashi provides traders with more precise signals when applied to the H4 timeframe or higher.

- The Heikin Ashi indicator must be combined with other indicators before opening positions.

Bottom Line

Heikin Ashi is an indicator widely used by professional traders to identify the current trend. Based on the candles color, body size, and shadows one may understand which trend dominates the market and how strong it is. The combination of Heikin Ashi with other instruments give traders more precise signals to open long and short positions.

Atualizado:

19 de dezembro de 2024