Volver

Contents

Understanding Energy Trading: How It Works

Demetris Makrides

Senior Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

Energy trading—buying and selling energy commodities like electricity, natural gas, oil, and renewable energy certificates—is an interesting and complicated component of commodities trading. This market assures stability of pricing and availability of energy by balancing supply and demand. One must explore the processes behind the dynamic market, the many forms of energy trading, and the main actors engaged in order to properly grasp energy trading.

What is Energy Trading?

Fundamentally, energy trading is buying and selling energy commodities to control pricing risk and satisfy market needs. The global economy depends on this dynamic and multifarious activity to guarantee effective distribution of energy resources at stable rates. Essential to energy security and economic stability as well as to help to balance market pricing, energy trading

Energy trading is the process by which merchants purchase and sell energy commodities, including electricity, natural gas, petroleum oil, and renewable energy certificates. Structured, centralized exchanges and over-the-counter marketplaces are among the venues where this takes place.

Market Dynamics

A multitude of elements shapes energy markets: geopolitics, climate, technical developments, and legislative changes among others. To predict price swings and make wise trading choices, traders have to be always analyzing these elements. For example, geopolitical concerns in areas that produce oil might cause supply interruptions, hence driving up oil prices. Likewise, extreme weather may affect energy output and consumption, therefore affecting the natural gas and electricity costs.

Types of Energy Commodities

Energy trade includes many different goods, and each has its own market conditions, selling tactics, and factors that affect it. It is important to understand these goods if you want to trade energy effectively.

Crude Oil

One of the most common energy goods in the world is crude oil. Petroleum goods like gasoline, oil, and jet fuel are made from this raw material. The price of crude oil changes a lot because of things going on in the world, gambling, and supply and demand.

Geopolitical Influence: Crude oil prices are very sensitive to variations in regional political stability, especially in the Middle East and other oil-producing countries. Large swings in price are possible outcomes of disputes, sanctions, and output agreements within OPEC.

Supply and Demand: Production rates from key oil sources, technical developments in extraction techniques, and infrastructural investment influence supply levels. On the demand side, global economic conditions, transportation needs, and seasonal variations influence consumption patterns.

Trading Tools: Often speculating on future oil prices, traders and investors cause brief price swings. Commonly used to either profit on predicted price increases or offset price volatility are futures contracts, options, and other derivatives.

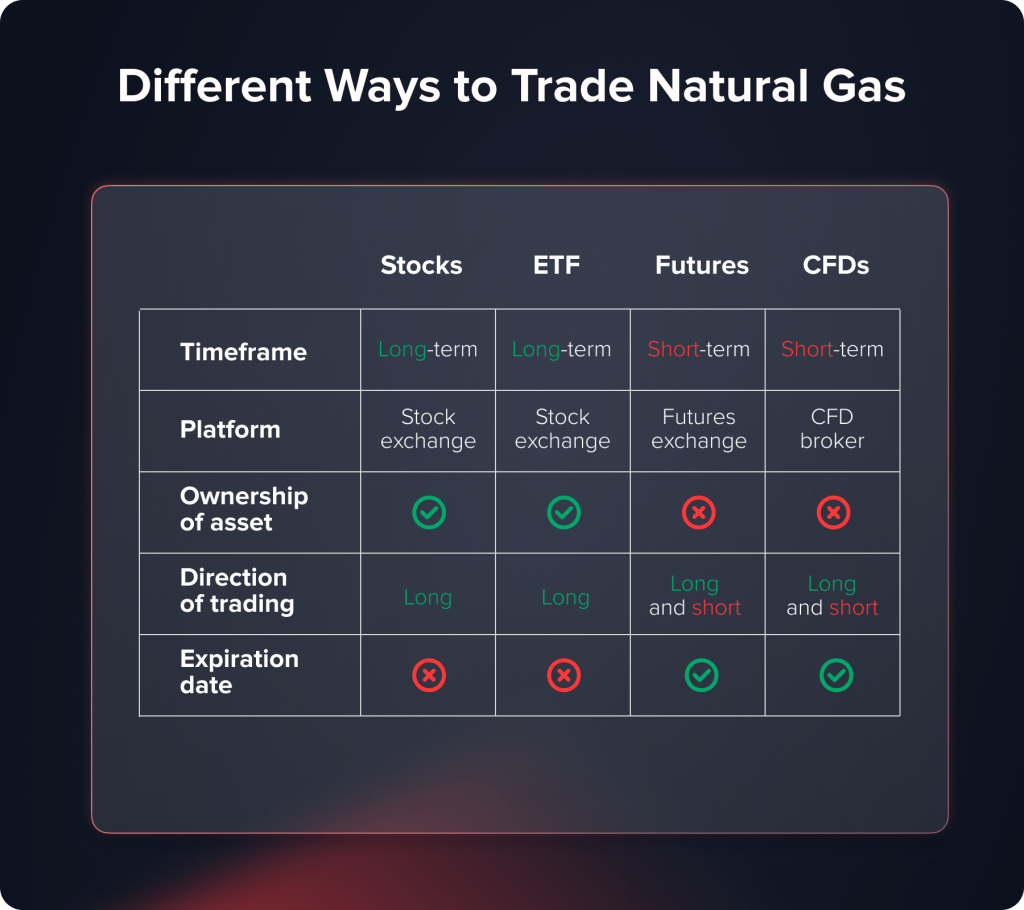

Natural Gas

Another vital energy item traded widely internationally is natural gas. It is used in heating, production of power, and other industry applications. Natural gas’s susceptibility to weather, storage capacity, and production rates defines its market.

Weather Conditions: Seasonal fluctuations—such as hot summers and frigid winters—can alternately raise or lower demand for heating and cooling. Significant price volatility might result from these variations in demand.

Storage Levels: Natural gas storage is a buffer to manage supply and demand fluctuations. Storage facility gas levels might point to future supply shortages or surpluses, therefore affecting pricing.

Production Rates: Hydraulic fracturing (fracking) and other extraction technology advancements have greatly boosted natural gas output, especially in the US. Nevertheless, economic feasibility, environmental concerns, and regulatory laws may all impact manufacturing rates.

Electricity

Because it cannot be readily stored, electricity trading is different from other energy commodities. This quality calls for a particular trading strategy, usually including complicated regulatory systems and real-time marketplaces.

Generation Capacity: The infrastructure that is in place—power plants, renewable energy installations, grid connectivity—determines whether anyone can create electricity. Variations in generating capacity affect market dynamics by means of new plant commissioning or decommissioning of existing ones.

Demand Fluctuations: Factors including industrial output, climatic conditions, and consumer habits influence daily and seasonal variations in electricity use. These variances must be continuously balanced in order to maintain grid stability.

Regulatory Policies: The power market is largely influenced by government rules. Policies supporting grid reliability requirements, carbon pricing systems, and renewable energy acceptance influence pricing and market operations.

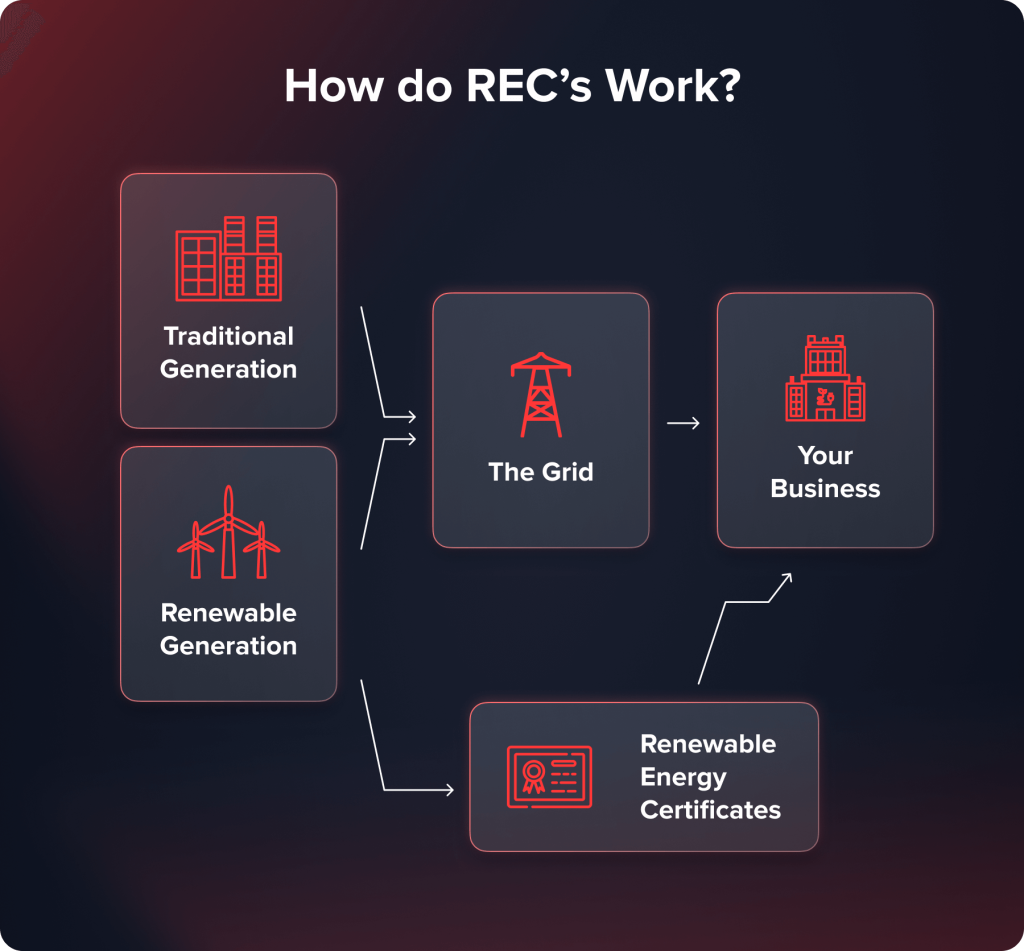

Renewable Energy Certificates

Renewable Energy Certificates (RECs) are documents attesting to the production of a certain amount of electricity from renewable energy sources, such as wind, solar, and hydroelectric power. Companies exchange RECs to help them meet voluntary sustainability goals or legal requirements.

Regulatory Compliance: Renewable portfolio standards set by several governments dictate a certain proportion of the power used to originate from renewable resources. To comply with these rules, utilities and businesses may buy RECs, therefore stimulating market demand.

Voluntary Markets: RECs are bought by companies and people to show their support for green energy growth and to follow the law. This voluntary demand adds an additional layer to the market dynamics.

Pricing Factors: The output of renewable energy, the particular kind of renewable energy, and regional market circumstances all affect REC pricing. Depending on their availability and market demand, solar RECs might, for instance, trade at different rates than wind RECs.

You may also like

Key Players in Energy Trading

Many organizations engage in energy trading; each one is essential for the operation of the market. To fully appreciate the complexity of the energy trading scene, one must first understand the roles and interconnections of these main participants.

Producers

Producers are the backbone of the energy market, comprising companies that extract or generate energy commodities. These include oil companies, natural gas producers, and power generation firms. Producers supply the raw materials essential for energy trading. ExxonMobil and Chevron, for instance, harvest crude oil from which different petroleum products are processed. Natural gas producers similarly collect and treat natural gas, which finds use in industrial operations, heating, and production of electricity. Traditional fossil fuel plants and renewable energy producers among other power generating companies create traded electricity in energy markets.

Producers are crucial because they initiate the supply chain, providing the commodities bought and sold in the market. Their production levels, influenced by technological advancements, exploration success, and regulatory policies, directly impact market supply and prices.

Consumers

Energy market consumers are big industrial users, utilities, and businesses running significant activities depending on consistent energy supply. These businesses trade energy to ensure they have a consistent supply of the fuel needed for their operations at reasonable rates. Main consumers of energy commodities include manufacturing companies, chemical producers, and transportation companies. Consumers also play a vital role for utilities, who provide gas and electricity to both home and business customers.

Many times signing long-term agreements to lock in energy costs and guard against future price volatility, these consumers do. By guaranteeing steady energy supply, they may better control expenses and assure continuous operations.

Traders and Brokers

Traders and brokers act as intermediaries for buyers and sellers of energy commodities, hoping to profit from price fluctuations. This category includes individual traders, trading firms, and investment banks. Investment banks such as Goldman Sachs and Morgan Stanley often have dedicated commodities trading desks for energy trading. Trading houses, such as Vitol and Glencore, are specialized firms that buy and sell large quantities of energy commodities on behalf of clients or for their proprietary trading activities.

Connecting buyers and sellers, independent traders and brokers negotiate agreements and guarantee seamless transactions. They are very important in giving the market liquidity so that additional participants may join and leave positions with ease.

To make wise trading choices, traders and brokers study geopolitical events, market trends, and other elements affecting energy prices. Their actions balance supply and demand and enable price discovery, therefore helping to stabilize the market.

Regulators

Regulators, government agencies and offices, monitor the energy markets to ensure they are fair and that policies are implemented. These agencies create and implement policies aimed to maintain consumer protection, integrity of the market, and fraud prevention. They monitor trade activity, look at any abuse, and apply laws meant to promote openness and competitiveness. To guarantee market control, authorities can, for instance, set position limits to stop too much speculation or mandate thorough documentation of trading operations.

The energy markets may be much changed by regulatory activities. Changes in environmental regulations or emissions criteria, for example, might affect the kinds of energy commodities traded as well as the market players’ strategy.

How Energy is Traded

Energy trading is the trading of energy commodities using different financial instruments, therefore enabling traders to speculate on future price changes:

- Futures Contracts: Trading energy starts with these. Futures contracts are legally bound and set a date, price, and amount for a future event. They can be used to buy or sell energy assets. Well-known markets like NYMEX are where futures contracts for natural gas and crude oil are sold.

- Options Contracts: Traders are not required to actually purchase or sell an energy commodity at the strike price, but they are given the option to do so within a certain time limit. Traders are given more power and freedom using options.

- Spot Trading: Spot trading is straight trading of energy commodities at the current market price. Spot markets let traders profit on quick market circumstances and leverage short-term price swings.

The Trading Mechanisms

Energy trading occurs through various mechanisms, each offering distinct advantages and suited to different trading needs. The primary mechanisms include organized exchanges and over-the-counter markets, each playing a crucial role in the energy trading landscape.

Exchanges

Formal markets where traders purchase and sell standardized energy contracts including futures and options are organized exchanges such the Intercontinental Exchange (ICE) and the New York Mercantile Exchange (NYMEX). These exchanges provide numerous main advantages that guarantee and ease the trading procedure.

Standardized contracts on these exchanges imply that the energy commodity has set amounts, quality, and delivery timeframes. This consistency guarantees that all participants understand the precise nature of their purchases or sales, therefore streamlining the negotiating process and lowering the possibility of misunderstandings.

Because market data—including price and trade volume—is openly available, exchanges provide a great degree of transparency. This openness enables traders to make wise judgments based on the state of the market. Besides, because many individuals trade on these sorts of platforms, there is plenty of liquidity. Since they may quickly buy or sell contracts without appreciatively influencing the market price, this lets traders open or exit positions more readily.

Through firms known as clearinghouses, exchanges serve as middlemen between buyers and sellers. The clearinghouse acts to ensure that both sides of a transaction satisfy their responsibilities. This procedure significantly lowers the possibility that one side may contractually default. Trading operations get more security as traders may be sure the contracts will be respected.

Over-the-Counter Markets

In contrast, OTC trading includes direct transactions between parties without the need of an exchange, allowing for more flexibility and contract modification. This method lets contracts be customized to fit the precise requirements of the parties engaged in terms of quantity, quality, delivery periods, and pricing systems.

- Customization

Particularly helpful for customized transactions that do not match typical exchange contracts, OTC contracts may be especially adapted to the requirements of the parties.

- Privacy

OTC transactions are generally private and not subject to the same level of disclosure as exchange-traded contracts, offering an advantage for those seeking confidentiality in their trading activities.

- Counterparty Risk

Unlike exchanges, OTC markets do not have intermediaries guaranteeing contract performance. This means that parties must rely on each other’s creditworthiness, increasing the potential for default risk.

A utility firm may, for example, work up a long-term natural gas supply deal with a producer. Customizing the contract terms—including volume, delivery schedule, and pricing formula—allows both sides to satisfy their particular requirements.

Contracts for Difference

Financial derivatives called Contracts for Difference (CFDs) let traders speculate on energy commodities’ price swings without having any underlying assets. Both institutional and individual traders are using this approach more and more because of its various compelling benefits.

With their great leverage, CFDs let traders initiate bigger trades with much lower funds. With this leverage, earnings may be increased and even little price swings in energy commodities provide significant returns. Although leverage raises the possibility for losses as well, many traders find great attraction in the capacity to handle bigger positions with less capital commitment.

CFDs provide exceptional flexibility, letting traders to purchase (long) or sell (short) energy commodities. Rising and declining markets allow traders to benefit, increasing opportunities regardless of market circumstances. Because of their versatility, CFDs are an ideal instrument for implementing a variety of trading methods.

CFDs are highly accessible and can be traded through numerous online platforms. This accessibility makes them popular for individual traders looking to participate in energy markets. Many brokers provide simple systems with modern trading tools, real-time data, and educational resources to assist traders get started and be profitable.

Using contracts for difference (CFDs), for instance, a retail trader in the energy industry may gamble on the price of crude oil. Leveraging their position allows the trader to significantly expose themselves to price changes, despite the fact that the initial commitment required is lower than that required to purchase genuine commodities or futures contracts. CFDs appeal to both novice and experienced traders because of their ease of use and margin trading capabilities.

You may also like

Getting Started with Energy Trading through a CFD Broker

Although starting the world of energy trading might appear intimidating, with the correct strategy and tools it becomes a rewarding activity. Contracts for Difference provide a convenient and flexible approach to participate in energy trading; CFD brokers provide the required tools and assistance to get going.

Step 1: Choose a Reputable CFD Broker

Choosing a respected CFD broker with a thorough trading platform comes first. Seek out brokers with good recommendations from other traders and good regulatory background. Important elements to take into account include easy-to-use interfaces, access to many energy commodities, strong security mechanisms, and first-rate customer service. For novices especially, several well-known CFD brokers additionally provide trading tools, market research, and instructional materials.

Step 2: Open and Fund Your Trading Account

Once you choose a broker, you have to open a trading account. Usually, this process includes filling an application form and providing certain personal identification to meet legal requirements. Once your account is approved, among other payment choices you may fund it using credit cards, e-wallets, or bank transfers.

Step 3: Educate Yourself

Before trading, one must first get well informed about the trading strategies and energy markets. Among other teaching resources, several CFD brokers provide seminars, tutorials, articles, and demos. A demo account offers a risk-free setting for platform knowledge acquisition and improvement of trading strategies by letting you practice trading with virtual money.

Step 4: Develop a Trading Plan

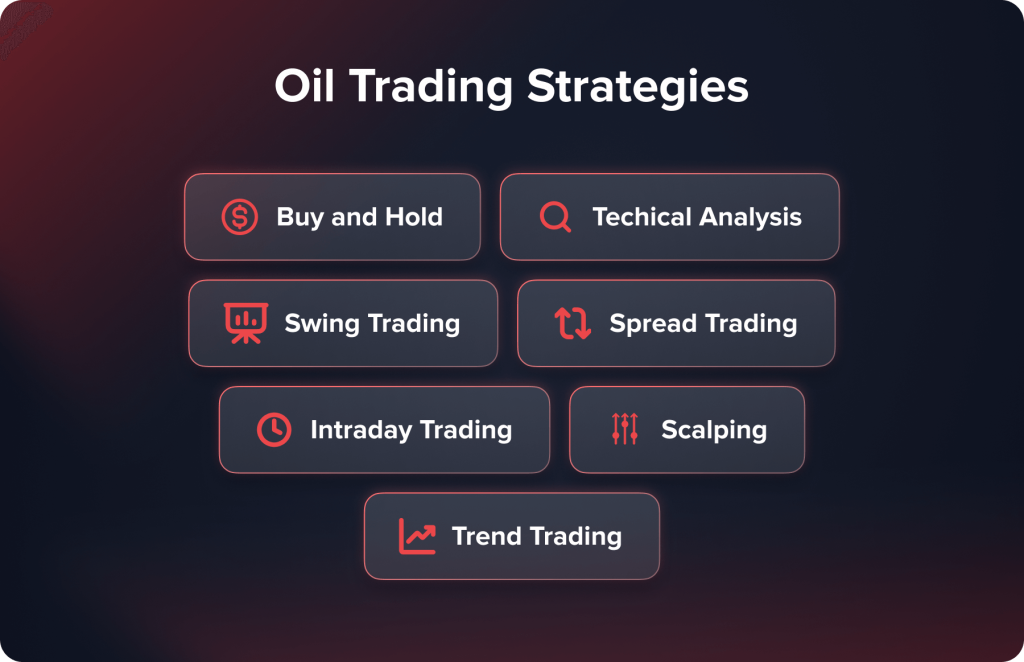

Success in energy trading depends on a properly considered trading strategy. Your strategy should call for risk tolerance, financial objectives, and trading entry and exit methods. To control any losses, you should determine the money you would risk on each trade and establish stop-loss thresholds. Additionally taken into account in your trading strategy should be market analysis methods like technical analysis (using charts and indicators to find trade prospects) and fundamental analysis (evaluating supply and demand variables and geopolitical events).

Step 5: Start Trading

With your account financed and your trading strategy in place, you may begin trading energy commodities. There are many energy commodities like crude oil, natural gas, and electricity accessible for trading on the online platform of your CFD broker. Your market research and projections will determine whether you want to go long—buy—or short—sell. Place orders, establish stop-loss and take-profit levels, and keep real-time position monitoring using the trading tools on the site.

Conclusion

A fundamental part of the world economy, energy trading affects the availability and price of necessary energy commodities. Appreciating the intricacy and relevance of this dynamic market requires one to understand the methods, kinds of commodities, important market participants, and risk management techniques. Energy trading efficiency and transparency should rise as technology develops, thereby strengthening its importance in the scene of energy use.

Actualizado:

18 de diciembre de 2024

12 de marzo de 2025

ES VERSION OF NEW POST FOR TESTING BLOG AND WP

What is Lorem Ipsum? Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also […]