Volver

Contents

Best Day Trading Indicators To Use

Iva Kalatozishvili

Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

Day traders negotiating the fast-paced financial markets must use appropriate indicators. Analyzing market behavior depends much on indicators such Moving Averages, RSI, MACD, Bollinger Bands, Volume Indicators, Stochastic Oscillator, and Fibonacci Levels. They assist traders in interpreting difficult data, projecting price swings, and pinpointing ideal moments of entrance and exits. Examining their unique uses, benefits, and ways to be successfully included into trading plans, this article explores these important indicators.

List of Best Day Trading Indicators:

- Moving Averages

- Relative Strength Index

- Bollinger Bands

- Volume Indicators

- Stochastic Oscillator

- Fibonacci Retracement Levels

- Moving Average Convergence Divergence

Moving Averages

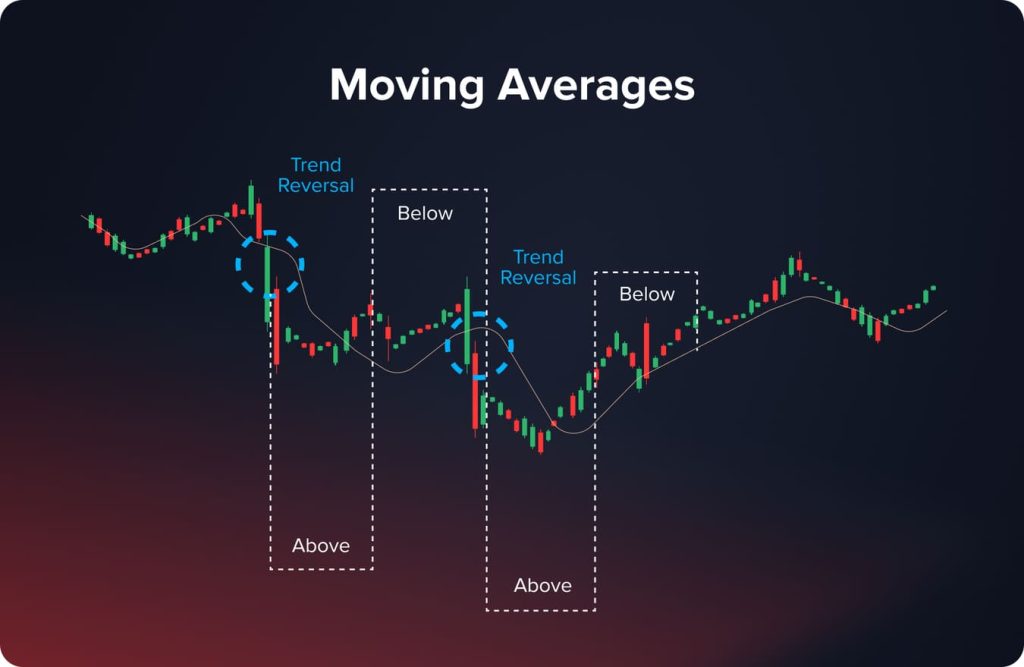

Basic indicators called moving averages serve to smooth out price data thus determining the direction of a trend. By running a security’s average price over a certain period, they help traders spot either bullish or bearish tendencies. Simple Moving Average (SMA), which approximates the average price over a given period while giving equal weight to all data points, and Exponential Moving Average (EMA), which gives more weight to the most recent prices, so increasing the sensitivity to fresh data, are two main varieties.

Support and resistance levels may be dynamically represented using moving averages. When the price trades consistently over the MA, this might mean an upcoming bullish trend; price action below could point to an approaching downward trend. Combining the 50-day and 200-day Moving Averages allows traders to spot either bearish death crosses or bullish golden crosses.

Relative Strength Index

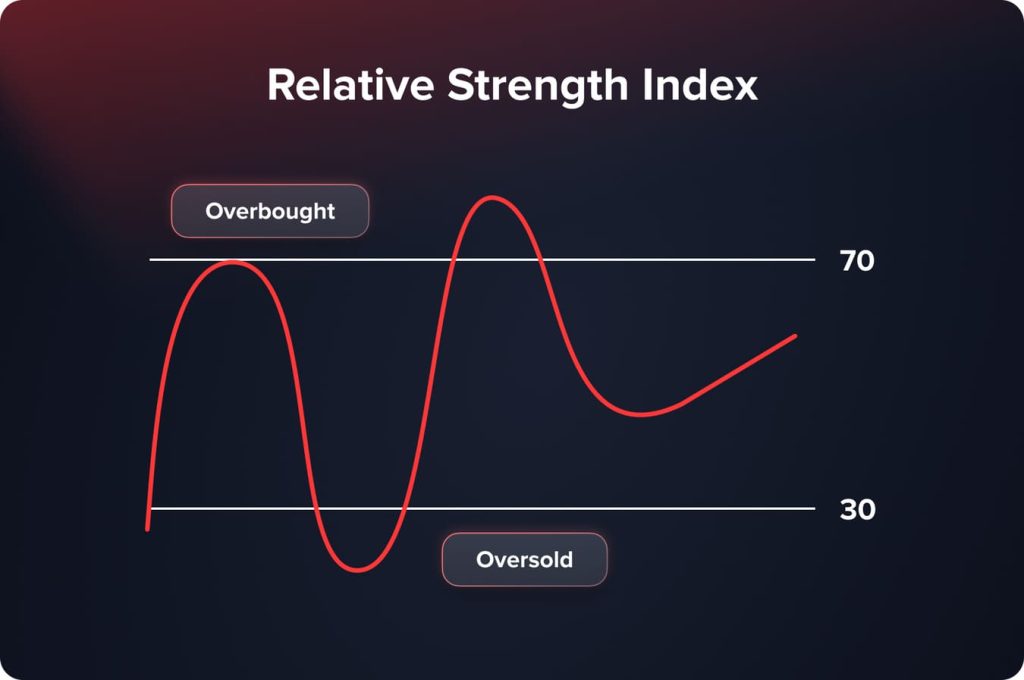

Evaluating the pace and change of price movements on a 0 to 100 scale, the RSI is a momentum oscillator. It helps one spot overbought and oversold market conditions. An RSI higher than 70 suggests overbought conditions—that the asset is expensive and requires a price correction. An RSI below 30 suggests that the asset is cheap, implying a possible price rise and oversold circumstances. RSI gives insight into the strength of a current trend as well as possible reversal points, making it useful for smart trade timing. Reverse signals may be found using RSI readings; trend strength can be validated; suitable entry and exit points can be found; consequently, trading strategies’ accuracy is improved.

Bollinger Bands

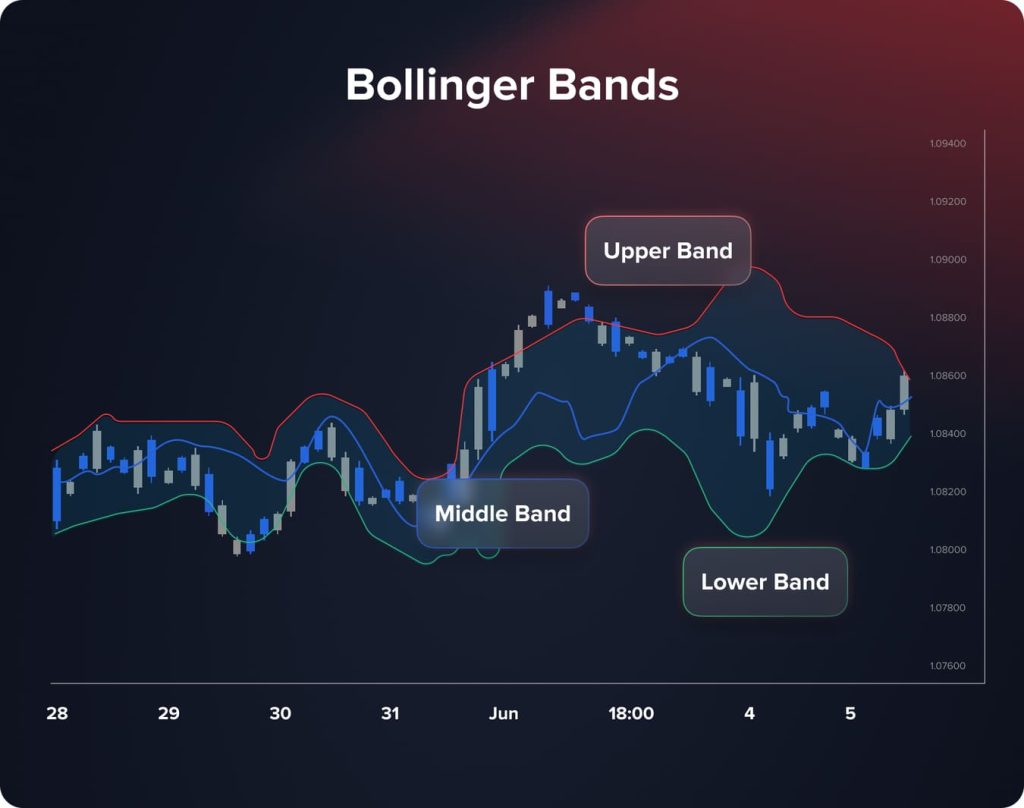

Usually a 20-day SMA, bollinger bands consist of three lines presented on a price chart: a middle band and an upper and lower band set two standard deviations above and below the central band. The growth and contraction of the bands depend on market volatility; they expand in times of great volatility and contract in low volatility ones. Touching the lower band might suggest oversold circumstances; the price may be overbited as it approaches the top band.

Bollinger Bands assist traders analyze volatility and find likely reversal or breakout points. Good timing of trades relies on traders being able to analyze market volatility, find prospective breakouts and trend reversals, and recognize overbought or oversold positions by means of examination of the interaction between price and the ranges.

Volume Indicators

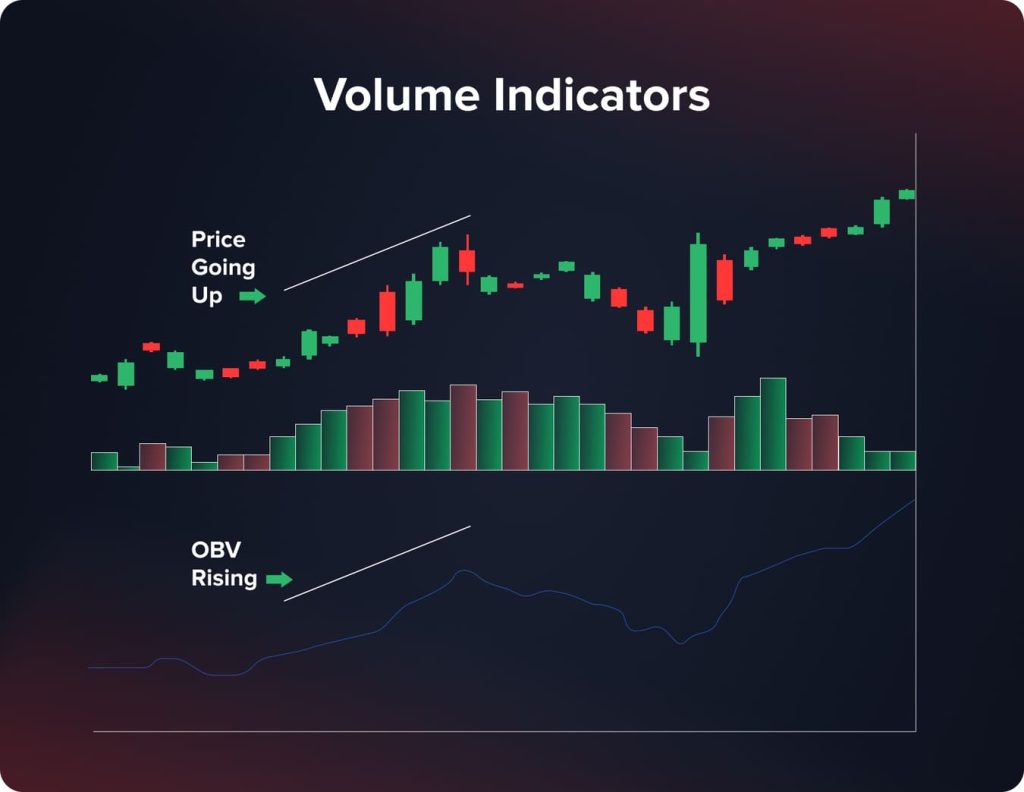

By means of analysis of the volume of an asset sold over a certain time, volume indicators help one to understand the state of the markets. By boosting volume on up days and dropping on down days, on-balance volume (OBV) gauges purchasing and selling pressure, therefore showing the total flow of volume.

Useful for evaluating trade execution quality, Volume Weighted Average Price (VWAP) computes the average price weighted by total transaction volume. While dropping volume may point to diminishing momentum, high volume generally supports strong trends.

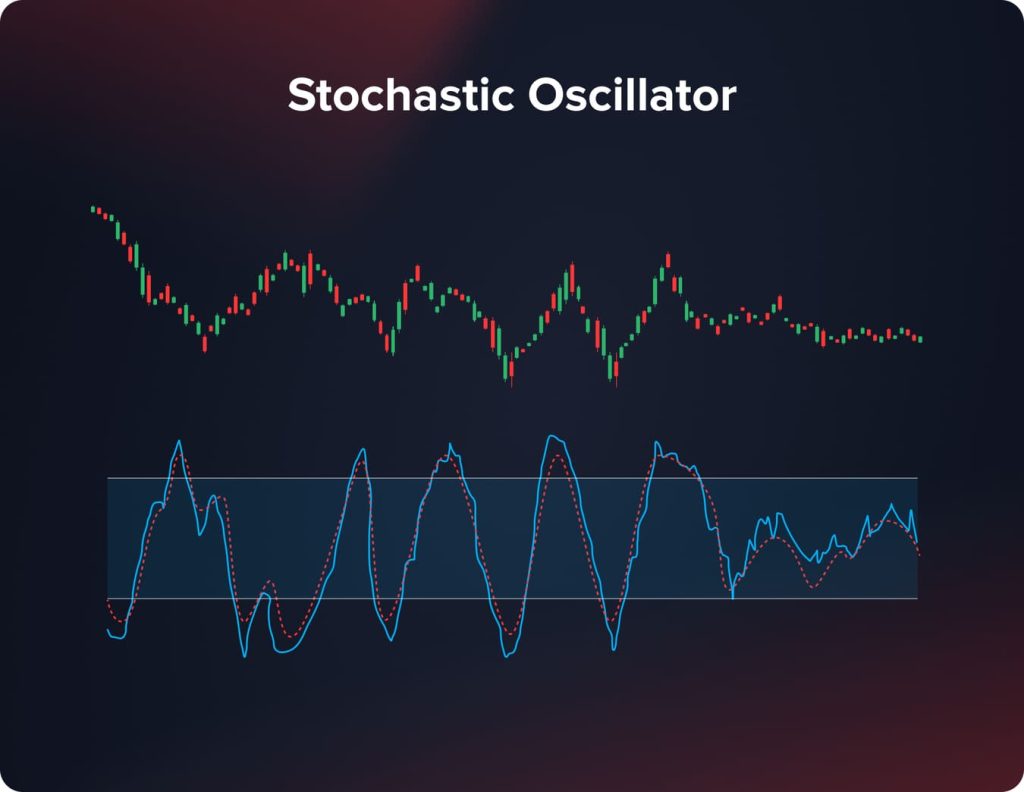

Stochastic Oscillator

The Stochastic Oscillator incorporates momentum indicators to track asset closing prices against their range over a given period. It ranges from 0 to 100, with readings below 20 suggesting oversold circumstances and readings above 80 maybe suggesting overbought conditions. When the indicator passes certain threshold levels, it suggests possible trend reversals. The Stochastic Oscillator aids in the identification of overbought and oversold positions, timing entrances and exits based on momentum changes, and validate signals from other indicators. Understanding what drives underlying price swings helps traders decide on more exact trading moves.

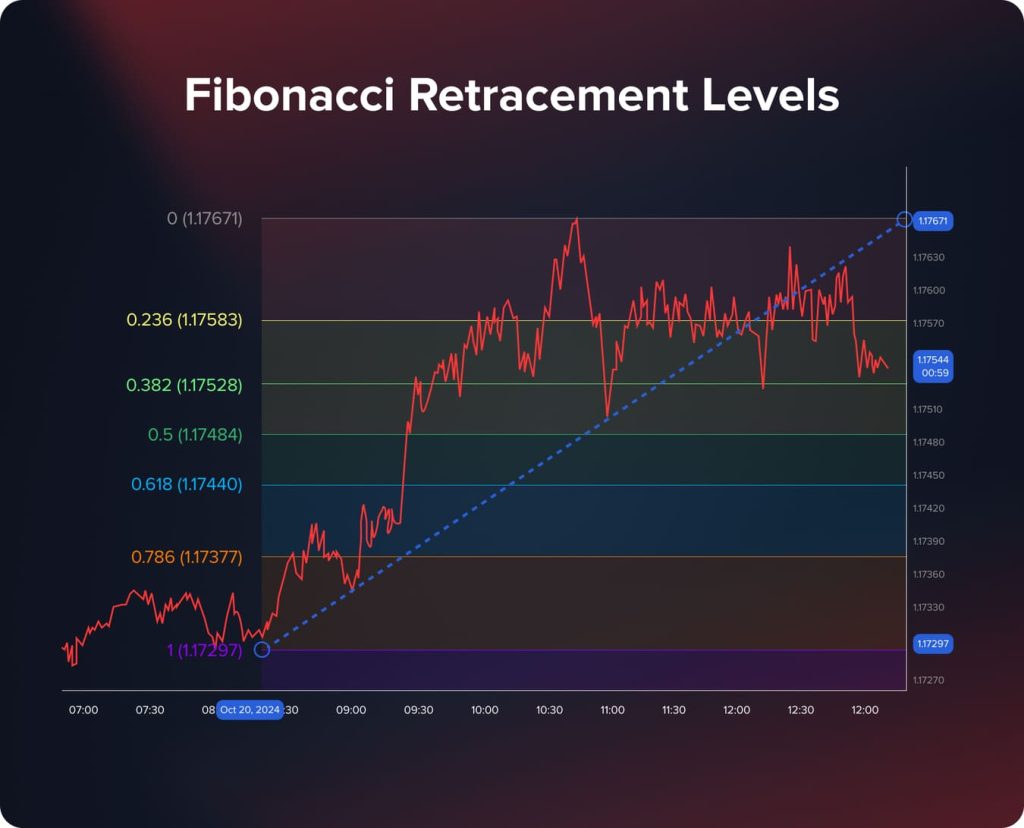

Fib Retracement Levels

Fibonacci levels are horizontal lines illustrating where support and resistance are most likely to occur based on significant Fibonacci ratios like 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels enable traders to project, within a longer trend, the likely degree of a market retreat or correction. Using the Fibonacci ratios and the distance between notable price movements, traders may find possible regions of support and opposition. Including Fib levels into trading strategies improves the efficacy of technical analysis, helps one predict price corrections and reversals, plan entrance and exit places in moving markets,and improves the accuracy of technical research.

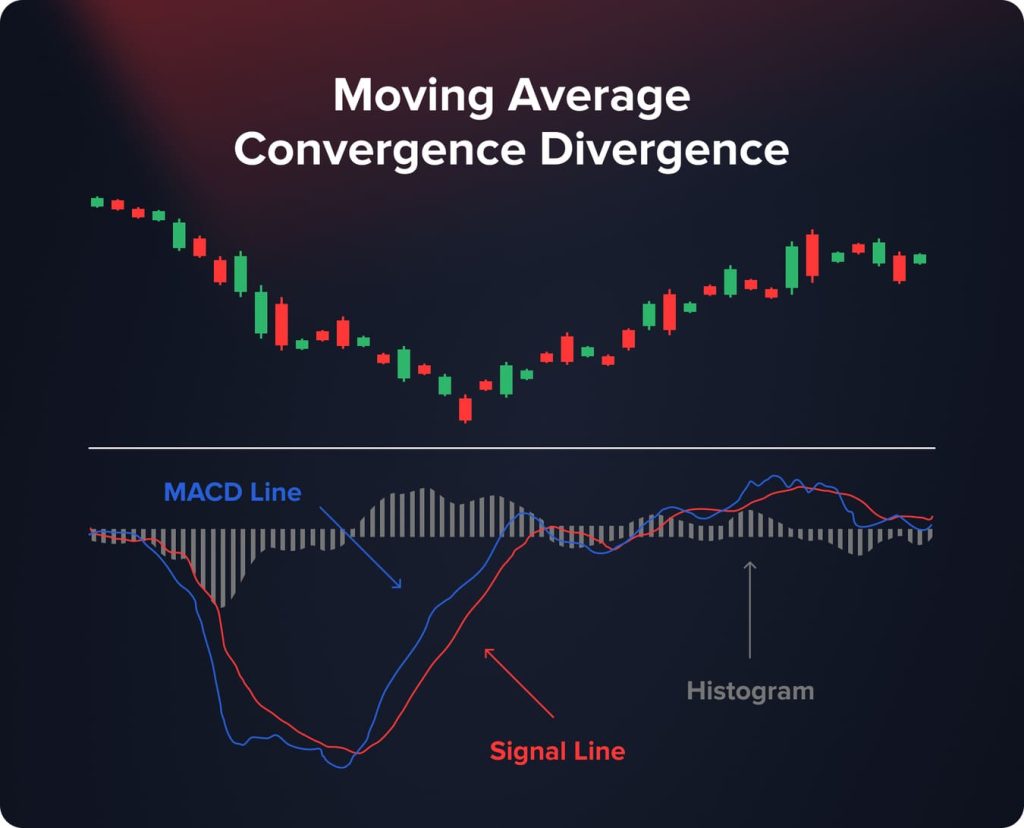

Moving Average Convergence Divergence

The Moving Average Convergence Divergence, or MACD, is one widely used indicator that allows traders to detect changes in the momentum and the overall trend of a stock. It contrasts the 12-period Exponential Moving Average (EMA) with the 26-period EMA of an asset.

Looking for crossings between the MACD line and the signal line, traders find possible buy and sell signals. A MACD line crossing above the signal line might point to rising upward momentum and a possible buying opportunity. On the other hand, when it falls below, it might indicate a possible selling chance and rising downward momentum. Analyzing these indications helps traders decide whether to join or leave positions with more knowledge.

Which Indicator Is the Most Accurate?

Finding the best accurate indication is a regular difficulty for traders as no one instrument can exactly anticipate changes in the market. Every indicator has different advantages and performs well depending on certain trade methods and market circumstances. An indicator’s accuracy usually relies on elements like the time period under analysis, asset volatility, and market trending or ranging nature.

For markets exhibiting obvious directional movement, for example, trend-following indicators as MACD and Moving Averages are more reliable. Predicting whether the trend will continue or reverse helps traders to capitalize on long-term price patterns. On other hand, oscillators as the RSI and Stochastic Oscillator may provide more accurate suggestions in range or sideways markets by spotting overbought and oversold levels.

Through validation of the strength of price movements, volume indicators increase accuracy. Since it shows greater market confidence, a change in prices accompanied by large volume is usually perceived to be of greater significance than one with low volume.

Relying solely on one indicator may lead to false signals, as indicators interpret past price data and are not infallible predictors of future movements. Market conditions can change rapidly, diminishing an indicator’s effectiveness.

Ultimately, the most accurate indicator is the one that aligns with your trading strategy, suits the current market environment, and has proven effective through your own analysis. Combining technical indicators with sound risk management and, when applicable, fundamental analysis, increases the likelihood of making well-informed trading decisions.

You may also like

MACD vs. RSI: Which Is Better?

The trader’s goals and the state of the market will determine which of MACD and RSI they should use. For spotting trend reversals and evaluating trend strength over a medium period, MACD is perfect. It excels in showing changes in momentum within a trend. Conversely, RSI is more suitable for identifying overbought and oversold situations, hence it is helpful for timing entrances and exits as well as for short-term trading options. Many traders find that utilizing both indicators combined offers a more complete picture. MACD improves trading signal dependability by verifying trends the RSI identifies. Combining the advantages of MACD and RSI will help traders improve their ability for smart trading decisions.

What Indicators Do Professional Traders Use?

In order to develop profitable trading strategies, professional traders use market data, sophisticated research tools, and technical indicators. Their method usually consists of developing tools to fit certain trading styles, merging technical analysis with fundamental elements to provide a complete market picture, and combining many indicators to confirm signals.

Technical indicators are important, but expert traders often use fundamental analysis to improve their trading decisions. They track market mood, business earnings reports, releases of economic data, and geopolitical events. Technical indications combined with fundamental knowledge will help one more accurately anticipate changes in the market. For instance, a bullish signal from technical indicators might be reinforced if fundamental analysis suggests positive economic growth or strong corporate performance.

Professionals often tailor indicators to fit their specific trading strategies and the assets they trade. They may adjust the periods of Moving Averages to better capture trends in different time frames or modify the sensitivity of the RSI to reduce false signals in volatile markets. Customizing indicators allows them to respond more effectively to market nuances and enhances the relevance of the signals generated.

Expert traders get a competitive edge using sophisticated tools and indicators. One such is the Ichimoku Cloud, a comprehensive indication on one chart that provides information on trend direction, support and resistance levels, momentum, and prospective trading signals, thereby allowing traders to quickly evaluate general market sentiment and identify possible breakouts. They also employ pivot points, which are derived by adding the previous day’s high, low, and closing prices, to help identify crucial support and resistance levels for the current trading day, allowing skilled traders to identify price levels where the market can experience significant swings.

You may also like

Psychological Aspects and Discipline in Trading

Good day trading calls for a solid psychological basis and disciplined attitude in addition to technical knowledge and good indicator usage. Emotional obstacles such fear of losses, greed for excessive profits, overtrading brought on by enthusiasm, or paralysis by analysis abound for traders. These feelings might distort judgment and cause rash decisions regardless of a properly defined trading plan. Overcoming these psychological obstacles requires discipline, which is really vital. Following an established trading strategy exactly helps one make unbiased decisions based on analysis instead of sentiment.

Managing expectations and creating reasonable objectives help to avoid the pursuit of unreachable goals that could cause frustration or reckless behavior. Building emotional resilience helps traders to stay focused on long-term success, remain calm under pressure and bounce back fast from mistakes.

Traders who identify their own biases and psychological factors could develop strategies to lessen their impact by scheduling frequent breaks, practicing mindfulness, or maintaining a trading diary to review decisions and results. In the end, a disciplined and psychologically balanced method improves the process of decision making and greatly helps ensure regular trading success.

Conclusion

Making smart and quick decisions in the often changing financial markets depends on choosing the right day trading indicators. Understanding and using these instruments well can help traders improve their ability to manage risks, spot best trading possibilities, and predict price fluctuations. Trading performance may be much enhanced by combining many indicators, modifying them to meet certain trading styles, and combining them with solid risk management techniques. Day trading success depends on ongoing education, experience, and rigorous application of carefully planned strategies.

FAQ

Since performance relies on how well an indicator is included into a trading plan, considering market circumstances and personal trading styles, no one indicator is intrinsically the most profitable. Many times, success results from integrating numerous indicators and excellent risk management instead of depending only on a single indicator.

Because they provide traders comprehensive visual information on price movements and patterns within short time frames, which helps them to make fast and educated choices, candlestick charts are often regarded as the best for day trading.

Yes, day trading may be profitable, but it is difficult and full of risk. Success in day trading is often dependent on ongoing learning, practice, and adherence to rigorous risk management standards. Before pursuing day trading as a full-time career, you should properly educate yourself about the markets and talk with financial specialists to understand the dangers.

Actualizado:

19 de diciembre de 2024

12 de marzo de 2025

ES VERSION OF NEW POST FOR TESTING BLOG AND WP

What is Lorem Ipsum? Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also […]