Volver

Contents

A-Book vs B-Book vs Hybrid Brokerage Models Comparison

Technology

Demetris Makrides

Senior Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

The financial markets and trading industry encompass many participants, including brokerage types. These brokerages offer advantages to their clientele. Among the recognized brokerage models are A book, B book and hybrid brokerages. Individuals contemplating establishing a brokerage must comprehend each model’s nuances as this can influence the profitability and risks associated with the brokerages. Given the role that brokerages play in the landscape comprehending these models and their distinguishing features is crucial for achieving success.

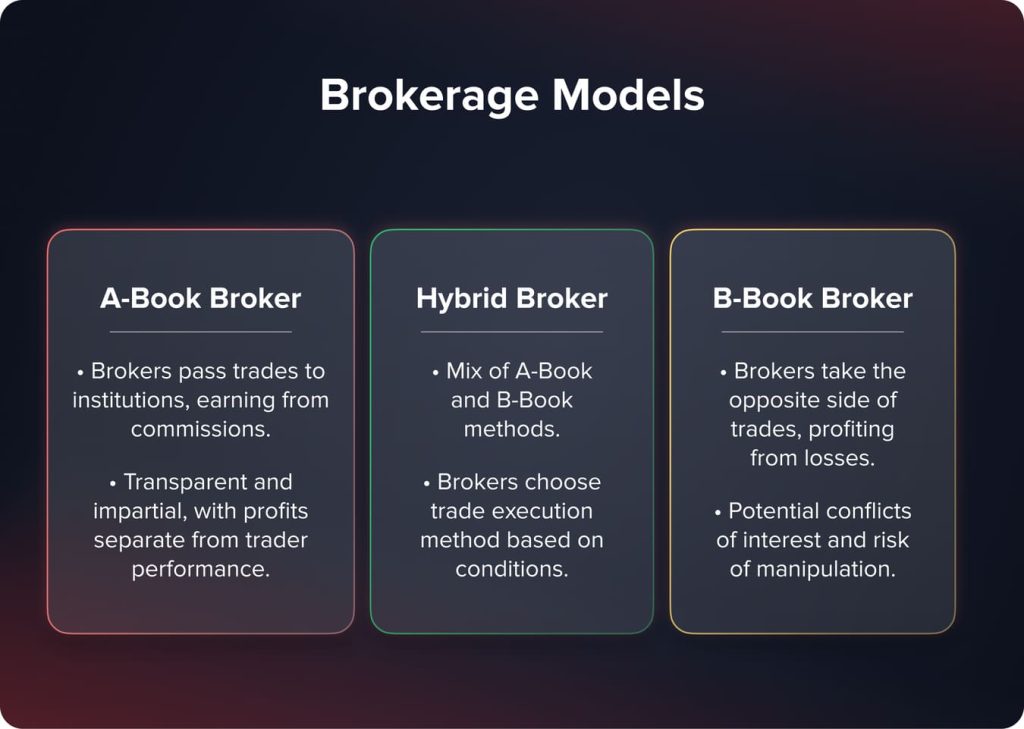

Different Brokerage Models

To navigate the realm of finance it is imperative to have a complete understanding of how brokerages function and what sets each model apart. Acting as a link between brokers and traders, a brokerage serves as the foundation of the trading process. The brokerage is accountable for ensuring a trading experience and customer satisfaction. The manner in which a broker executes trades manages risks, upholds transparency and ensures fairness hinges on the chosen brokerage model.

Therefore it’s crucial to delve into each model examining the inner workings, advantages and disadvantages.

A-Book Brokerage Model

Let’s start by looking at the A Book model, where the broker’s role is straightforward; they simply transmit traders orders to financial institutions, like banks as an intermediary. In this setup the broker doesn’t counter the traders position. This approach is also called the Straight Through Processing (STP). The brokers’ earnings solely stem from commissions and spreads rather than trading activities, promoting transparency. Since the brokers profits are independent of traders performance they can maintain an impartial stance in facilitating trades.

You may also like

B-Book Brokerage Model

Conversely the B book brokerage model operates in contrast to the A Book. Here the brokerage does take opposite positions to those of traders. For instance if a trader goes long on a market position, the broker takes a position and vice versa.

If the trader performs well, the brokerage loses money. If the trader experiences losses, then the brokerage profits. This situation can lead to a conflict of interest, as the brokerage benefits from traders losing their trades. While managing all risks internally by not sending trades to another institution has its advantages, it could also encourage behaviors such as stop loss hunting and price manipulation that negatively impact traders. Such practices may make it challenging for this model to attract a customer base and highlight the importance of maintaining levels of transparency.

Hybrid Brokerage Model

The Hybrid model combines elements of both the A book and B book models. In this scenario the broker has the flexibility to decide whether to execute orders through an institution or handle them in house. This decision depends on factors such as market conditions, trader profiles and risk management strategies implemented by the broker.

The Hybrid model aims to combine the transparency of the A book model, with risk management to the B book model.

Evolution of Brokerage Models

The evolution of brokerage models reflects the changing needs of traders and the continuous pursuit of enhancing risk management and profitability for brokers. Initially brokers heavily relied on B Book models using their positions to control risk and secure profits internally. However this method often created unfavorable conditions for traders, leading to a transition towards transparent and equitable trading environments.

In response to this shift the A Book model emerged, promoting transparency by linking traders to the market and reducing conflicts of interest. Although advantageous for traders, this approach posed revenue challenges for brokers, thus giving rise to the Hybrid model. The Hybrid model provided an approach that allowed brokers to optimize risk management and revenue generation while upholding fairness and transparency.

Each model offers its set of benefits, drawbacks and operational processes influenced by the changing dynamics within the trading industry.

As we explore further into each model in the following sections, traders and brokers will gain insights to help them choose the model that best fits their trading strategies, ethical considerations and financial objectives.

A-Book Brokerage Model

The A Book model serves as a bridge connecting traders with the markets. In this model brokers relay traders’ orders directly to liquidity providers, including banks, major institutional brokers and other financial entities. Instead of taking positions opposite to their clients’ trades, brokers in this framework primarily act as intermediaries.

In the A Book model larger financial institutions play a role by offering market options and ensuring efficient order completion. They enable real time market prices and trade execution, promoting transparency and credibility within the trading environment.

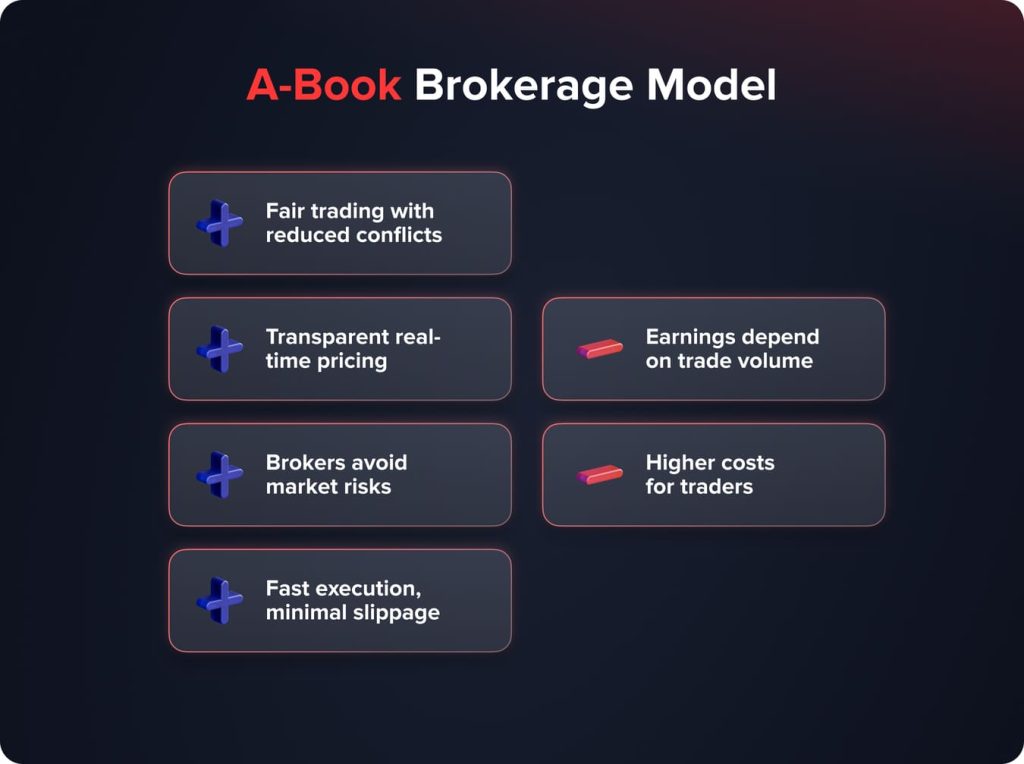

Pros of A-Book Brokerage Model

One of the benefits of the A Book brokerage model is establishing a fair trading environment. By transmitting trades to liquidity providers or interbank markets without opposing traders positions this system reduces conflicts of interest. This is perceived as a more equitable approach.

Traders have the opportunity to access market data and view buy and sell prices, which is essential for those who heavily rely on market analysis for their trading strategies. This transparency fosters a sense of trust between the broker and the trader, which is vital for long term success in the trading industry.

Another key benefit of the A Book model is its capability to protect brokers from market risks. In contrast to the B Book model where brokers are exposed to profits or losses from traders positions, the A Book model mitigates this risk by directing orders to liquidity providers. This ensures that brokers earnings remain unaffected by market fluctuations or traders’ wins or losses. Such a risk averse strategy proves valuable in times of high market volatility safeguarding the stability of brokers.

You may also like

Additionally the A Book model enables diverse market access while offering execution speeds to minimize slippage. This swiftness and efficiency hold importance for traders utilizing strategies like scalping, where profits often stem from exploiting price variations over a brief period.

Cons of A-Book Brokerage Model

Nevertheless despite its advantages, the A Book model does come with its set of difficulties.

Relying solely on commission and spread based revenue can pose challenges for brokers as their earnings are more closely linked to trade volumes than the profits or losses from trades. In times of trading activity or market standstill, brokers may face a decrease in revenue flow, affecting their profitability. This limitation underscores the importance of building a client base and implementing client retention tactics.

For traders operating under the A Book model, commission and spread costs may be relatively higher leading to increased trading expenses. This setup might not be financially viable for traders with smaller accounts or those who prefer trading in large quantities. It is crucial for such traders to carefully evaluate the cost implications to ensure that trading expenses do not outweigh profits.

B-Book Brokerage Model

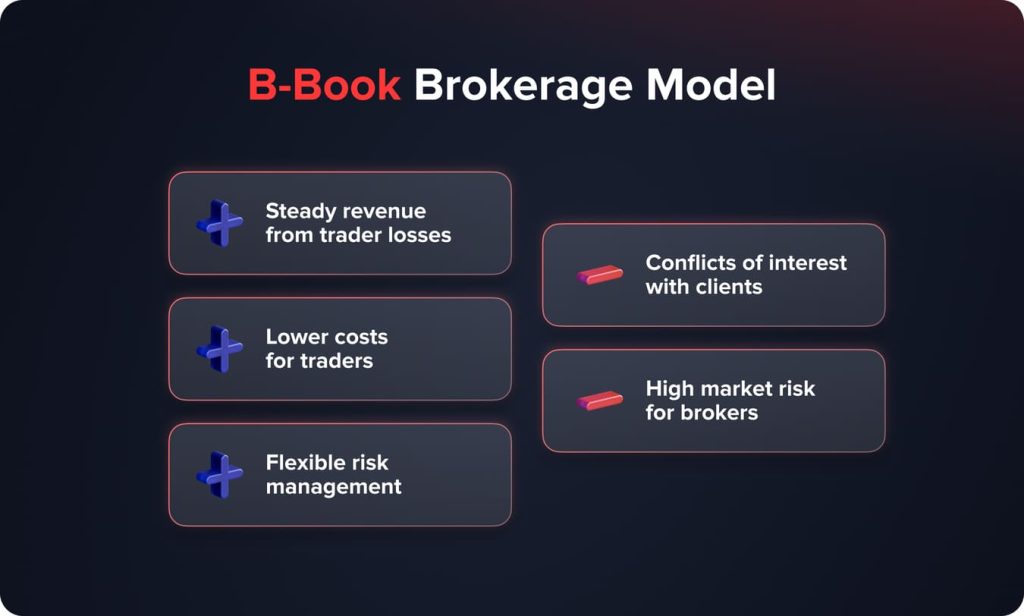

The B-Book model represents a distinct operational strategy where brokers effectively act as the counterparty to their traders’ positions. In this model, instead of routing orders to external liquidity providers, brokers keep the trades in-house, potentially profiting from the traders’ losses.

To manage the risks associated with this model, brokers employ sophisticated risk management strategies and algorithms. These tools help identify and segregate trading accounts based on their risk profiles, allowing brokers to hedge certain positions externally if they deem the risk to be too high, ensuring the broker’s financial stability and sustainability in volatile market conditions.

Pros of B-Book Brokerage Model

The B-Book Brokerage Model allows brokers to act as market makers, creating a distinct internal market for their clients. This approach provides a substantial opportunity for profit, as brokers can benefit from traders’ losses, offering a consistent revenue stream independent of market conditions or trade volumes. This means that even in periods of low market activity, brokers have the potential to maintain stable revenue generation.

Another benefit is the ability to offer reduced transaction costs, especially appealing to traders with limited account balances. By managing the market, brokers can provide spreads and lower commissions, making trading more accessible and financially feasible for a wider range of traders. This cost effectiveness is vital for traders aiming to maximize profits while minimizing expenses.

Moreover the flexibility and the control inherent in the B Book model empower brokers to effectively manage their risk exposure. They can adjust spreads and leverage offered to traders based on risk evaluation ensuring a regulated trading environment. The ability to adjust offerings in time is crucial for maintaining broker stability and reducing losses.

Cons of B-Book Brokerage Model

Yet the B Book model comes with conflicts of interest since brokers directly profit from traders losses. This can create a perception of lack of transparency and distrust, potentially straining the broker trader relationship. Traders may be cautious of broker manipulation and may question the fairness and trustworthiness of the trading environment provided.

Moreover, brokers face market risk as they take positions opposite those of traders. In volatile markets brokers are exposed to large losses if numerous traders make profits. This underscores the need for risk management strategies and constant monitoring to navigate market fluctuations and maintain stability.

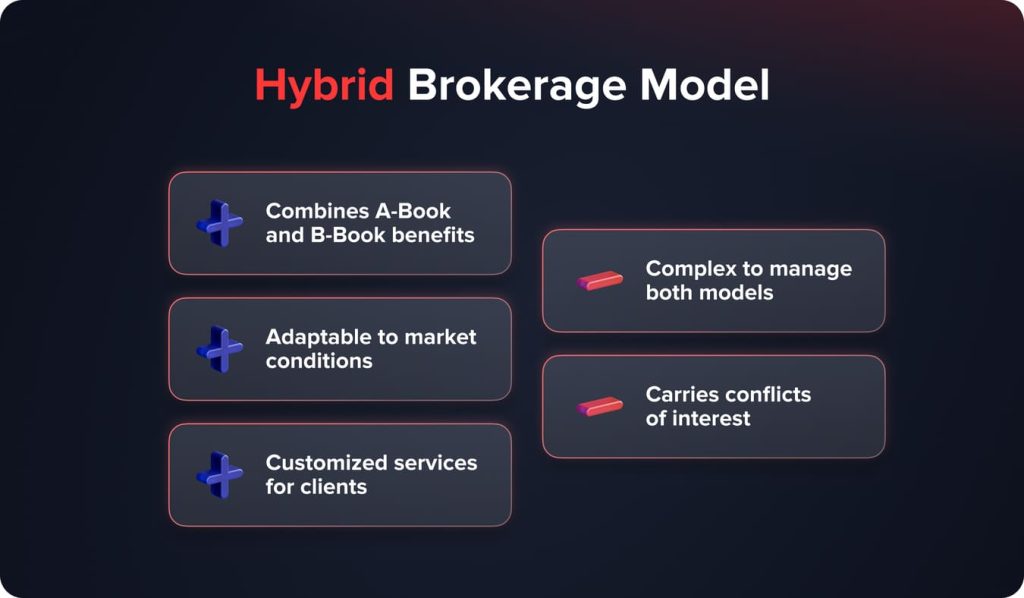

Hybrid Brokerage Model

The Hybrid brokerage model ingeniously marries the attributes of both the A-Book and B-Book models, offering brokers a versatile and adaptive operational approach. In this integrated framework, brokers possess the discretion to either pass a trader’s order directly to external liquidity providers or keep it in-house, thus acting as a counterparty.

Pros of Hybrid Brokerage Model

The Hybrid Brokerage Model combines elements from both the A Book and B Book models to capitalize on their benefits. This blend provides brokers with an approach to managing risk and generating revenue efficiently. By evaluating market conditions, trader profiles and risk levels brokers can seamlessly switch between A Book and B Book operations to enhance profitability while reducing exposure.

The flexibility of the Hybrid model allows brokers to cater to diverse clients with varying trading preferences, offering customized services that boost customer satisfaction and loyalty. By aligning their strategies with traders’ needs and market trends brokers can create a harmonious trading environment.

Cons of Hybrid Brokerage Model

Managing both A Book and B Book operations concurrently presents hurdles. It demands technology, sophisticated risk management tactics and continuous monitoring for integration and execution of both models.

The Hybrid model is quite intricate and demands planning, execution and oversight. Additionally, it carries over the conflicts of interest from the B Book model. Striking a balance between transparency, fairness and profitability poses a challenge that requires consideration and effective communication to uphold trader trust and satisfaction. Brokers must navigate these dilemmas with care to maintain a fair trading platform.

Regulation and Ethical Considerations

In the world of brokerage strict regulations and ethical guidelines play a humongous role. These are established by global regulatory bodies such as the Financial Conduct Authority (FCA), the Commodity Futures Trading Commission (CFTC), and the Australian Securities and Investments Commission (ASIC), to ensure the security and fairness of trading practices. These institutions formulate and enforce rules that brokers must adhere to, ensuring transparency and fairness, and protecting the interests of traders.

Regulations cover aspects of brokerage such as transparency, leverage, margin requirements and client protection. They are essential for upholding a morally upright trading environment. These regulations evolve with changes in markets to address risks and challenges in brokerage operations, underscoring the importance for brokers to stay informed and compliant.

Ethical Considerations in Brokerage Models

Brokerage models come with their unique operational characteristics that bring forth specific ethical dilemmas, especially concerning conflicts of interest and maintaining trust in broker-trader relationships. For instance in B Book models where brokers may profit from traders losses, transparent operations along with standards are crucial to preserve trust.

In Hybrid models that combine A Book and B Book practices, balancing transparency, fairness and profitability becomes complex due to their nature. Effective communication plays a role in maintaining trust and satisfaction among traders within these models. It is essential to address these ethical considerations as it fosters trust, strengthens relationships and promotes the sustainability and prosperity of brokerage firms in the trading landscape. Ensuring alignment with frameworks enhances the bond between traders and brokers, securing the long term viability and success of brokerage firms.

Final Thoughts

Having an understanding of the brokerage models, how they work and the ethical considerations associated with them is essential, for both traders and brokers. It’s crucial to choose a brokerage model that matches your trading goals, risk tolerance and the ethical principles of the models to ensure a trading experience built on transparency, trust and mutual respect. Brokers need to align their tactics with requirements and ethical norms to create a fair and transparent trading environment that supports the sustainability and legitimacy of their business. When ethical standards, regulatory guidelines and individual preferences are in harmony it fosters a fair and balanced trading environment that benefits both traders and brokers in today’s markets.

Actualizado:

18 de diciembre de 2024

12 de marzo de 2025

ES VERSION OF NEW POST FOR TESTING BLOG AND WP

What is Lorem Ipsum? Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also […]